Prominent analysts have predicted significant price increases for Injective (INJ) and Lender (RNDR) tokens. This article discusses the factors driving these predictions and the long-term growth potential.

概要

- Analysts expect Injectives (INJ) to rise 340%

- from current levels to reach USD 100.

Render (RNDR) is expected to rise to USD 150, which represents a 2,000% spike. - Injective and Render face headwinds, but their technical and underlying potential is strong.

- Both tokens have significant market activity and support from the crypto community.

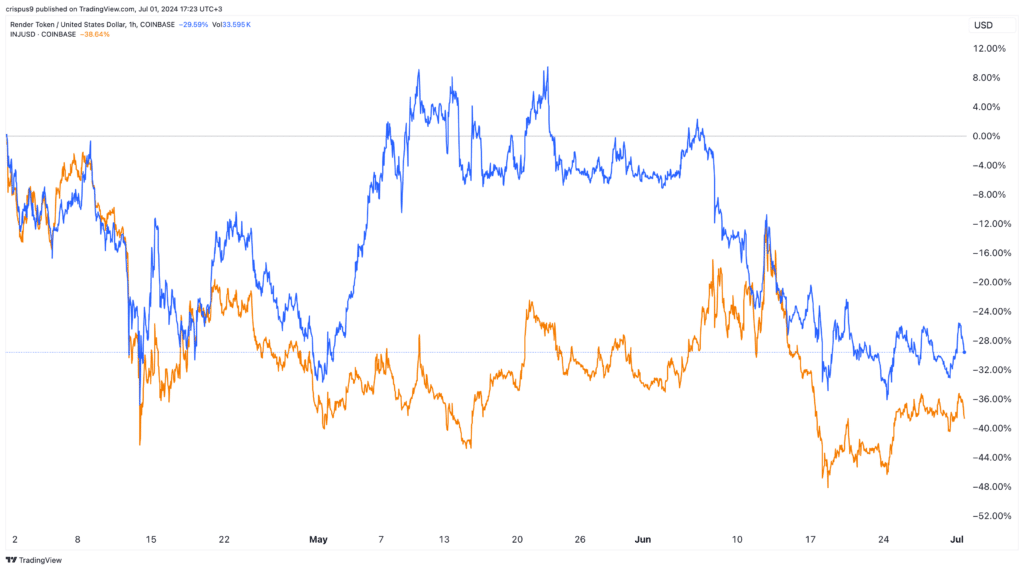

Injective (INJ), a venture-backed blockchain that made a splash in 2023, experienced a significant price drop and collapsed

56% from its highest price since the beginning of the year. Despite this decline, well-followed analyst Sensei predicts that INJ could see a significant bullish breakout in the long term, potentially reaching USD 100. This would represent a 340% increase from current levels.

Injective and Lender bullish forecasts.

The teacher, who has over 33,000 followers on X, bases his analysis on both technical and fundamental factors. He notes that Injective is forming a promising chart pattern and is finding strong support, increasing the potential for a rebound. The analyst also predicts that the lender (RNDR) could rise to USD 150, which would represent a 2,000% surge from the current price. This prediction is based on the formation of a cup-and-handle chart pattern on the monthly chart and the strong support the token has found.

Market activity and headwinds

Injective, a blockchain network designed for the financial industry, has seen asset volumes decline in recent months: after peaking at USD 204 million in March, volume fell to USD 114 million, the lowest level since 17 February. Nevertheless, Helix, the company’s largest decentralised exchange (DEX), has processed more than USD 59 million in transactions in the past 24 hours. Furthermore, developers report that more than USD 1 billion worth of INJ tokens have been bet on the chain.

Render Network, which faces stiff competition from platforms such as Akash Network, a platform offering decentralised GPUs, is also experiencing significant market activity. Both Injective and Render are battling a lack of major market-moving news in the virtual currency industry and concerns about the possibility of a new virtual currency winter like the one that occurred between November 2021 and November 2022.

Conclusion

The bullish forecasts for Injective and Lender by analyst Sensei highlight the potential for significant long-term growth, despite current market headwinds. Both tokens exhibit strong technology patterns and have substantial market activity and support from the crypto community. Investors should look to these tokens as they navigate the challenges and opportunities in the evolving cryptocurrency environment.