The article discusses the upcoming launch of spot Ethereum exchange-traded funds (ETFs), market expectations, and the potential for a “sell the news” scenario.

Points

- Spot Ethereum ETFs set to debut on July 23.

- Market anticipation and potential for quick asset accumulation.

- Previous experiences with futures-based ETFs.

- Potential price sensitivity and market volatility.

The cryptocurrency community is abuzz with anticipation as spot Ethereum exchange-traded funds (ETFs) are set to debut on July 23, following the SEC’s rule change over two months ago. This launch is expected to draw significant attention from investors, who are hopeful that the ETFs will see quick asset accumulation, boosting Ethereum’s market presence.

“The launch of the futures-based ETH ETFs in the US late last year was met with underwhelming demand. All eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

— Will Cai, head of indices at Kaiko

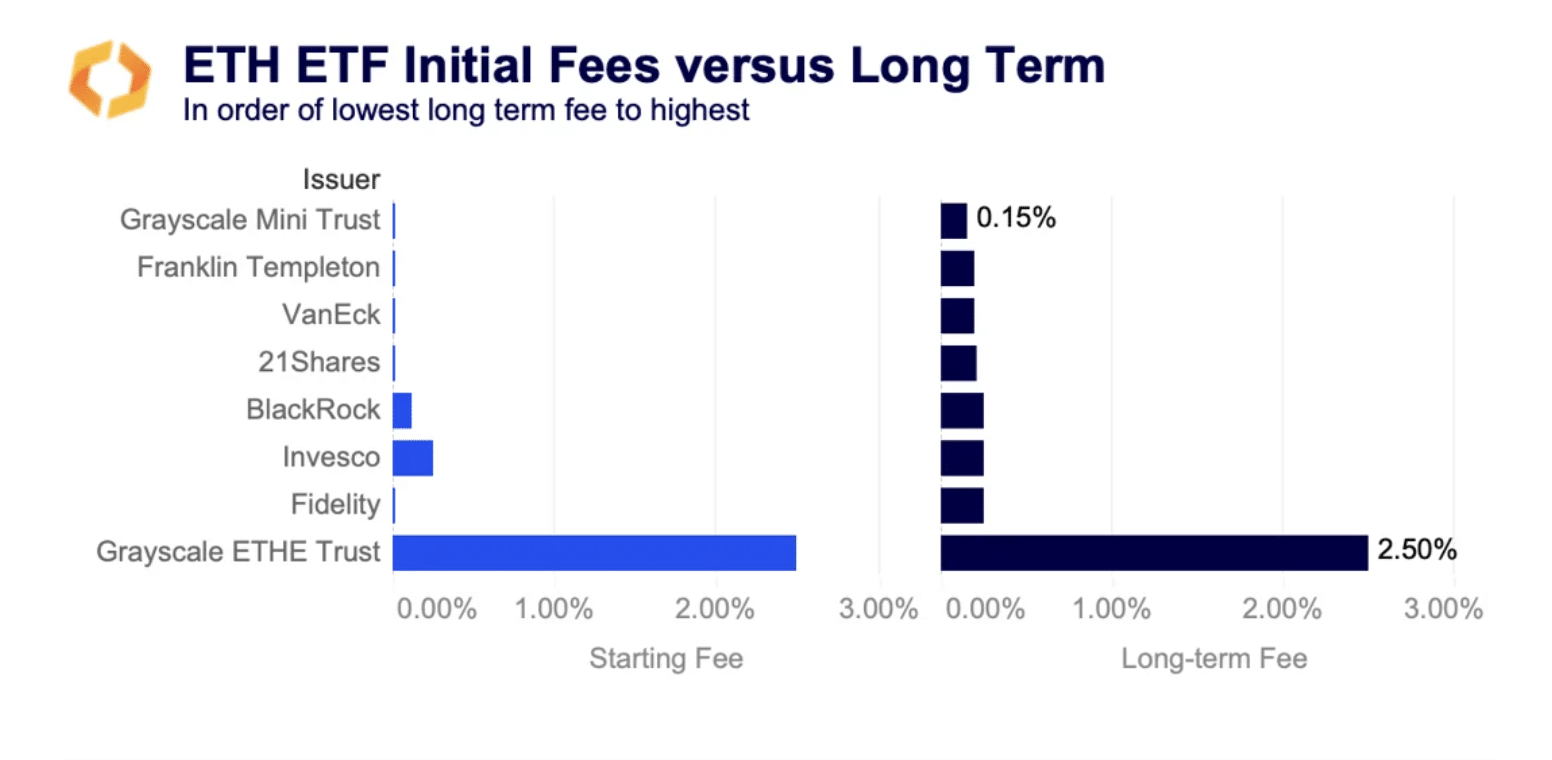

Several prominent firms, including BlackRock, Fidelity, Bitwise, VanEck, 21Shares, Invesco, Franklin Templeton, and Grayscale, have ETFs set to begin trading on July 23. This widespread involvement of established financial institutions is seen as a positive development for Ethereum and the broader cryptocurrency market.

https://twitter.com/JSeyff/status/1815395664051818873

Additionally, according to Kaiko, contracts expiring in late July have experienced a rise in volatility from 59% to 67%, indicating the market’s anticipation and potential price sensitivity to initial inflow numbers.

解説

- The launch of spot Ethereum ETFs represents a significant milestone for the cryptocurrency market, potentially increasing institutional investment and market stability.

- Market anticipation is high, but investors should be cautious of a potential “sell the news” scenario, which could lead to short-term volatility.

- Previous experiences with futures-based ETFs highlight the importance of managing expectations and monitoring early inflow numbers.

- The involvement of major financial institutions in launching these ETFs is a positive sign for Ethereum’s market legitimacy and growth.

- Investors should stay informed about market reactions and consider both the short-term risks and long-term opportunities presented by the ETF launch.