Explore why Pyth Network has the potential for a 400% increase and how it compares to Chainlink in the competitive oracle market.

Points

- Pyth Network shows potential for significant growth in the oracle space.

- Chainlink remains a dominant player but faces competition from Pyth.

- Key metrics such as market cap, price feeds, and latency are crucial in evaluating these oracle networks.

Despite being a market leader in the oracle space, Chainlink (LINK) is showing signs of stagnation compared to newer, more dynamic competitors like Pyth Network (PYTH). Analyzing their market responsiveness and correlation with Bitcoin reveals a stark contrast in their potential to reach previous all-time highs. This article explores why LINK may struggle to achieve its ATH again and how Pyth’s market dynamics position it for significant growth.

Introduction to Oracle Networks

Blockchains are closed systems that only know what is recorded on their own chain, but many applications require data from the “outside world.” Oracles fill this gap by bringing off-chain information onto the blockchain, allowing smart contracts to interact with real events and market changes.

Without oracles, smart contracts would be limited to using only on-chain data, severely restricting their practical applications. By providing access to external data, oracles significantly expand the capabilities of blockchain technology. They make possible complex applications like crypto-backed loans that adjust to market prices or insurance policies with automated payouts based on weather events.

What Are PYTH and Chainlink

PYTH is a decentralized oracle network that provides high-frequency, low-latency financial data, particularly for the DeFi sector. It sources real-time data directly from top financial institutions and trading firms, making it highly reliable and accurate. Additionally, PYTH’s data is fully verifiable on-chain.

Chainlink, on the other hand, is a more established and versatile oracle network that has been in the market longer and serves a broader range of industries. While it also provides price feeds, Chainlink’s strength lies in its ability to integrate various types of off-chain data into smart contracts, making it applicable to sectors such as insurance, supply chain management, and gaming. Unlike PYTH, which focuses on speed and financial data accuracy, Chainlink offers a more generalized service.

Market Position and Supply Dynamics

Supply Overview

To evaluate Pyth Network’s future price, one must compare its position to that of Chainlink, which currently leads the oracle industry. While some believe PYTH could surpass Chainlink soon, maintaining a conservative approach offers a more realistic perspective.

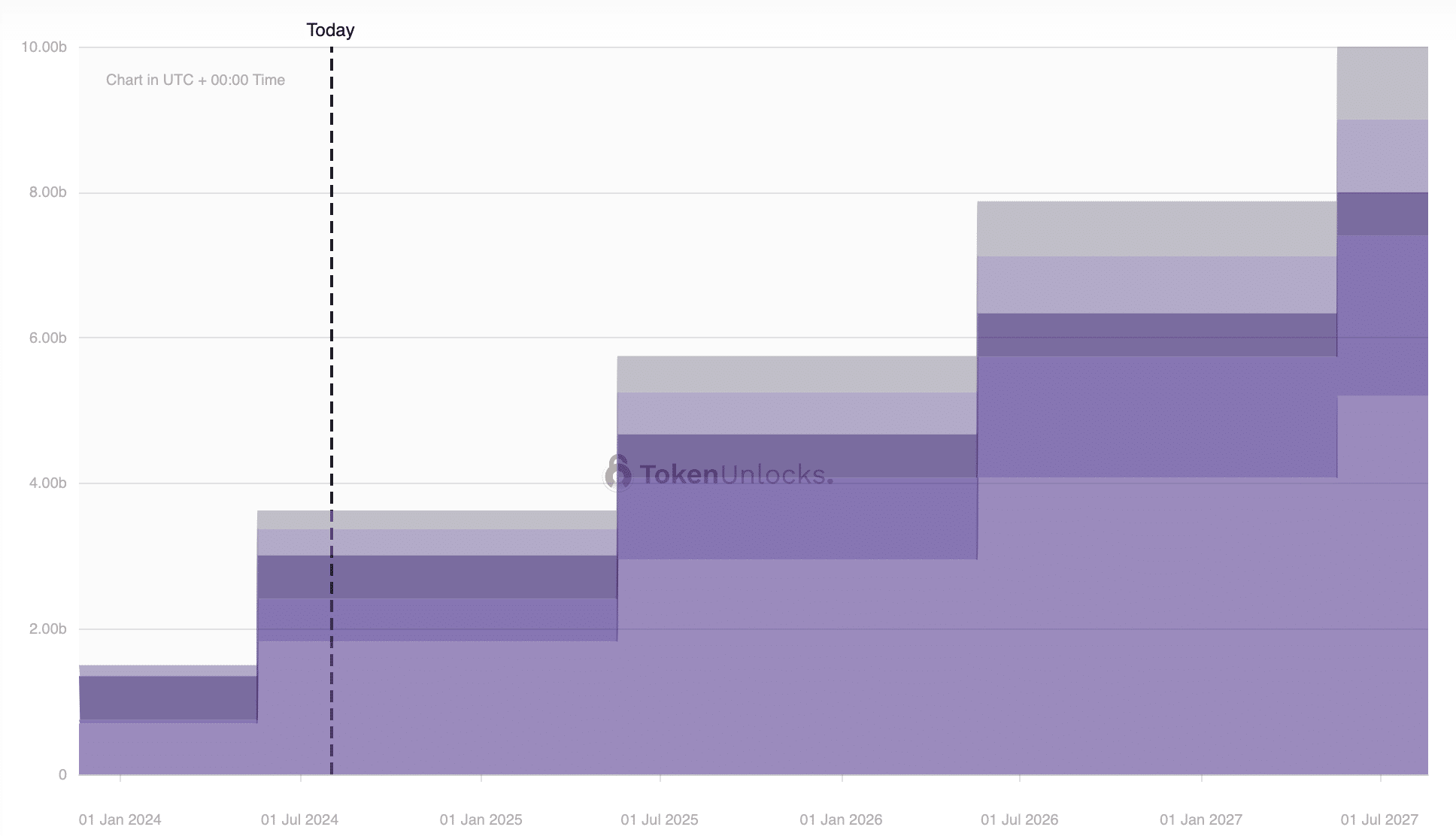

Source: Token Unlocks

By projecting this trend forward, the expected Chainlink supply by May 2025, just before PYTH’s next unlock, would reach approximately 664,045,167 LINK.

Historical Price and Supply Correlation

An increasing supply can dilute the value per token due to inflation. For PYTH, this isn’t a concern until the next unlock. However, it is important to note that when the unlock occurs in May 2025, PYTH will release 2.125 billion PYTH, diluting the current supply by over 58%.

YearSupplyMarket CapPrice at ATH Market Cap2021425,009,554 LINK$ 22.48B$ 52.882025664,045,167 LINK$ 22.48B$ 33.85**

Market Cap Analysis

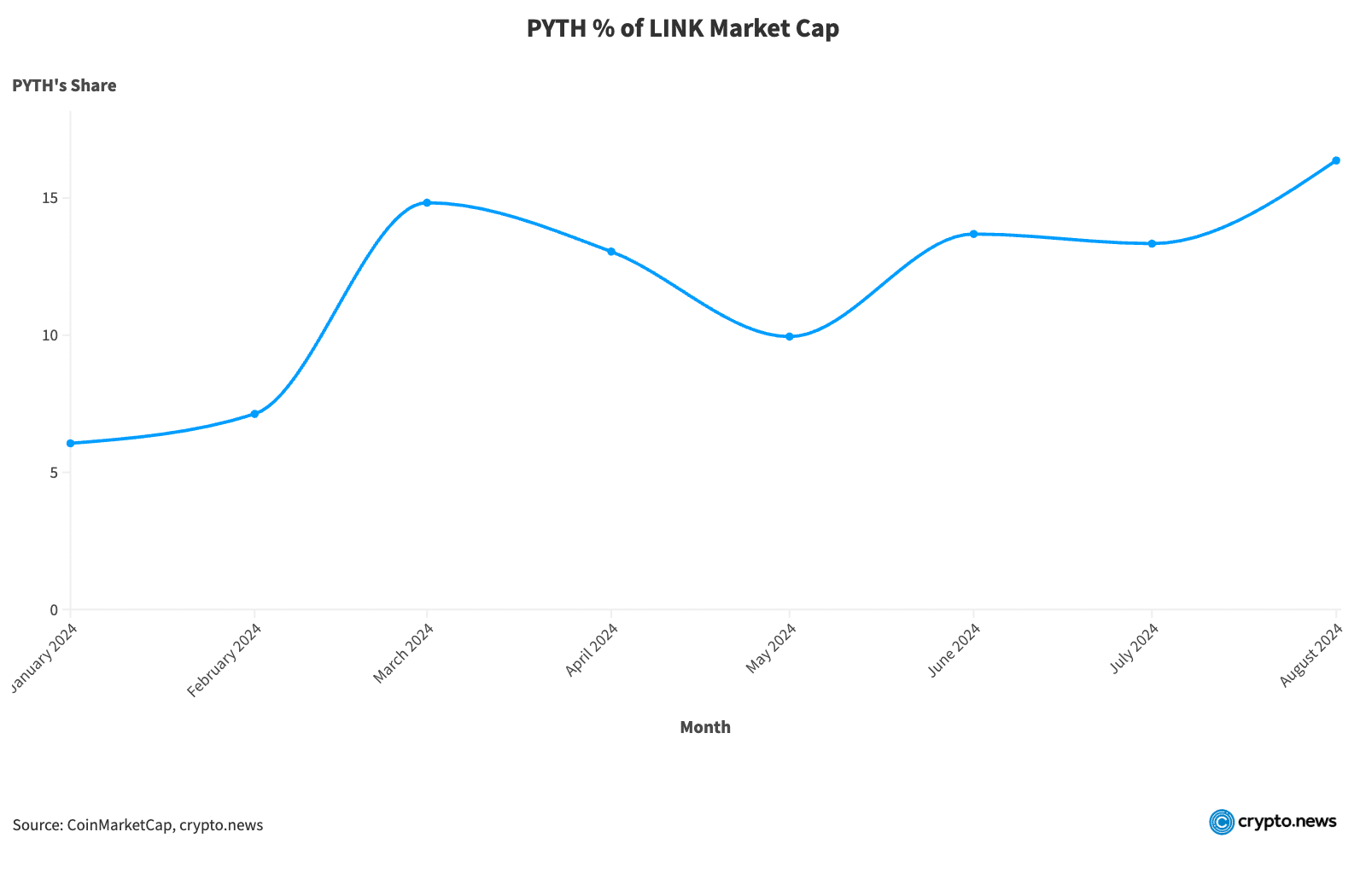

At the start of 2024, PYTH represented a modest portion of Chainlink’s market cap. On January 1, 2024, PYTH’s market cap stood at $535 million, capturing only 6% of Chainlink’s market cap, which was $8.826 billion. However, this ratio began to shift significantly as the year progressed.

By March 2024, PYTH’s market cap had surged to $1.73 billion, representing 14.83% of Chainlink’s $11.64 billion market cap. Despite market fluctuations and a general cooling down, PYTH maintained its higher share of Chainlink’s market cap. As of July 31, 2024, PYTH’s market cap is $1.28 billion, or 16.37% of Chainlink’s $7.8 billion.

The trend suggests that PYTH is steadily gaining ground on Chainlink, which could have significant implications for its future positioning within the oracle market. This data will become even more relevant as the analysis delves deeper into PYTH’s future price action and market dynamics.

Adoption and Performance

dApps and Total Value Secured (TVS)

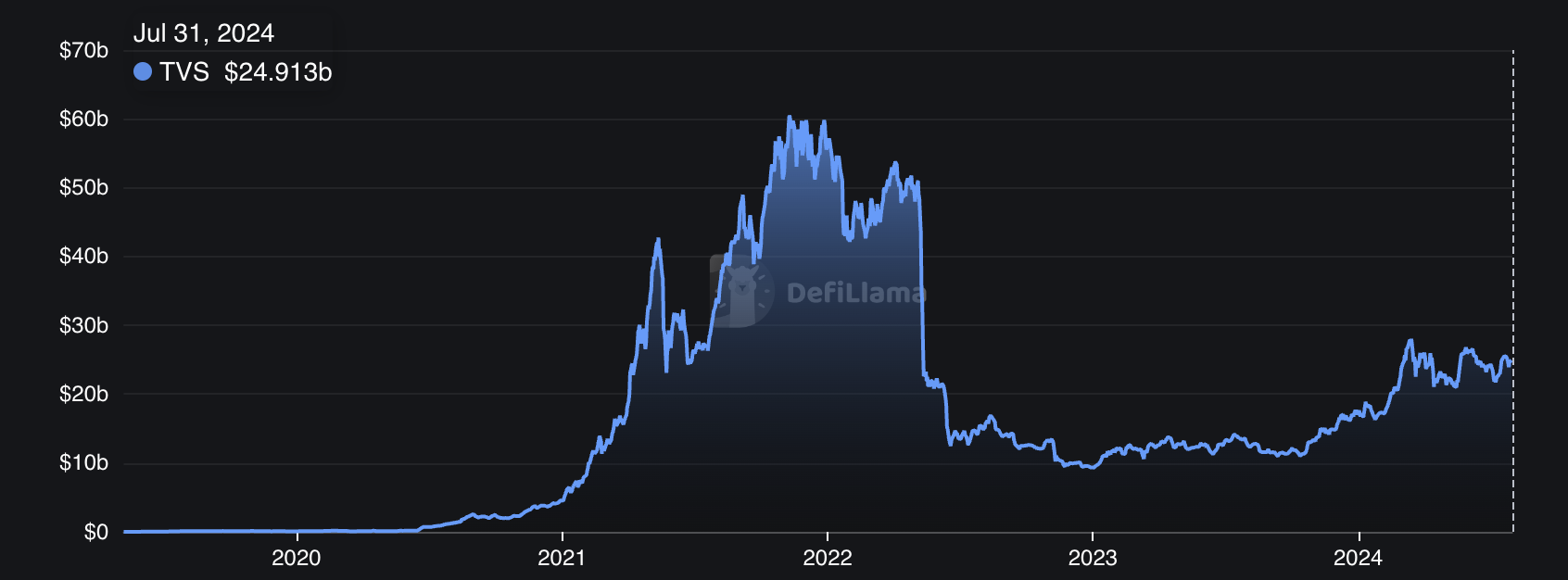

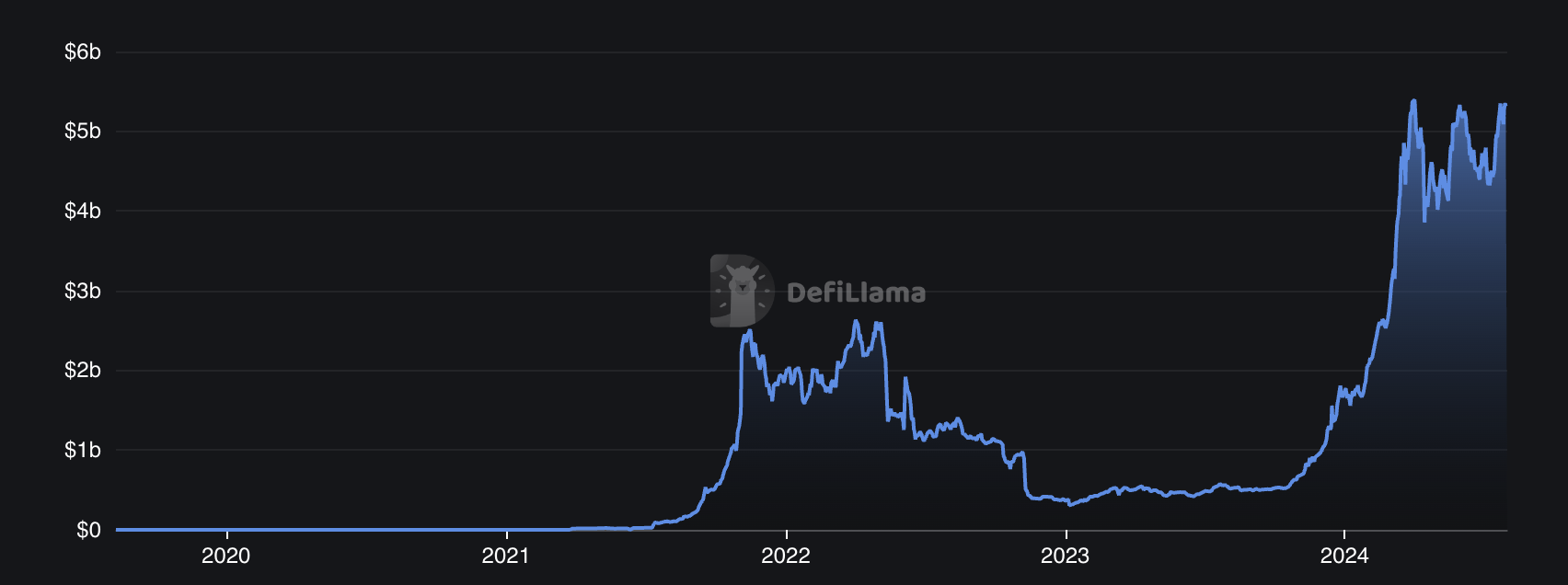

Total Value Secured (TVS) represents the total amount of assets or financial value that an oracle network safeguards through its data feeds. This metric serves as an important benchmark in the comparison of different oracle networks because it reflects the trust and reliance that decentralized applications (dApps) and smart contracts place on the network. A higher TVS indicates broader adoption and greater confidence in the oracle’s ability to provide accurate and secure data.

Chainlink’s TVL, Defillama

While the difference between Chainlink and Pyth remains substantial—nearly a 5x gap—Pyth’s rapid growth raises questions about whether it could eventually surpass Chainlink in securing value. Nevertheless, Chainlink remains the dominant player in the oracle space, and given its extensive adoption and established infrastructure, it is likely to retain its leadership position through 2025.

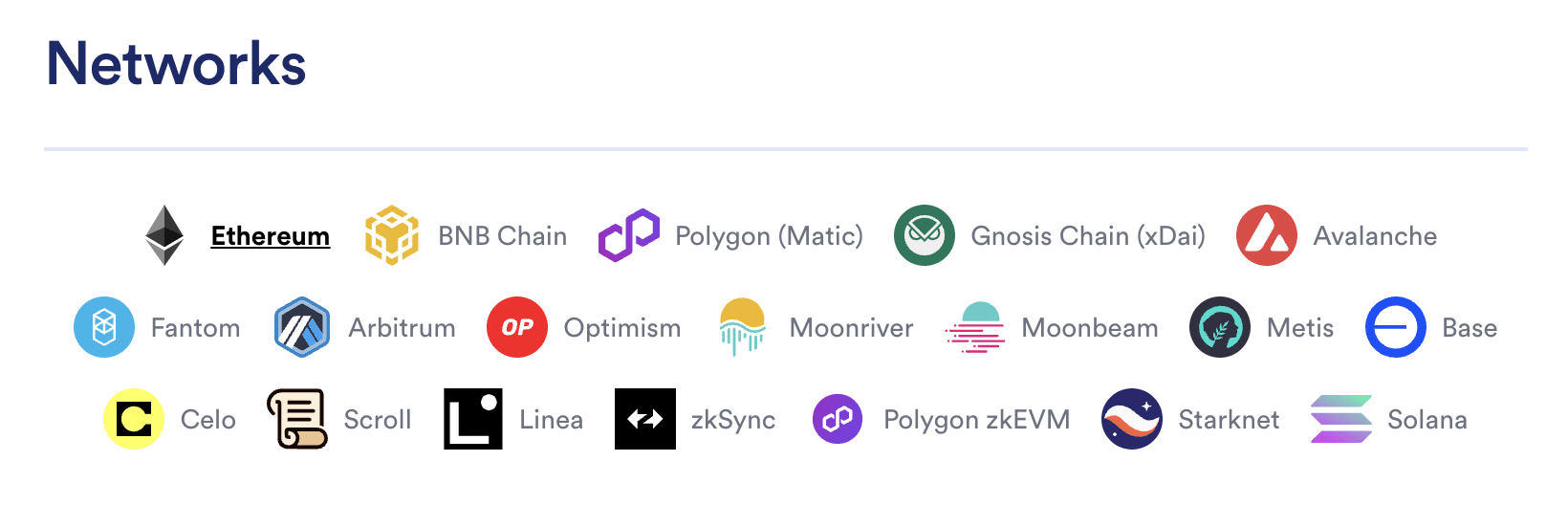

Price Feeds and Supported Blockchain Networks

Chainlink’s supported blockchain networks, Chainlink Docs

Starting with just Solana in August 2021, PYTH rapidly expanded its reach. By its first anniversary, PYTH had already implemented 83 price feeds.

9/

📅 Aug-22:

🏦 67 Data Publishers

💲 83 Price Feeds

🔮 73 #PoweredByPyth Apps

📈 $27.6B Cumulative Trading Volume Supported

https://twitter.com/PythNetwork/status/1609897462256529408

One of the biggest complaints from DeFi developers: not enough price feeds on their preferred chains.

Challenge accepted.

Pyth supports over 550 price feeds across 70 blockchains.

https://twitter.com/PythNetwork/status/1816881264424816921

70 blockchains and counting 🥂

Wherever you build, Pyth will be there, with hundreds of low-latency, high-frequency price feeds to secure your app.

https://twitter.com/PythNetwork/status/1811807779713343650

Latency

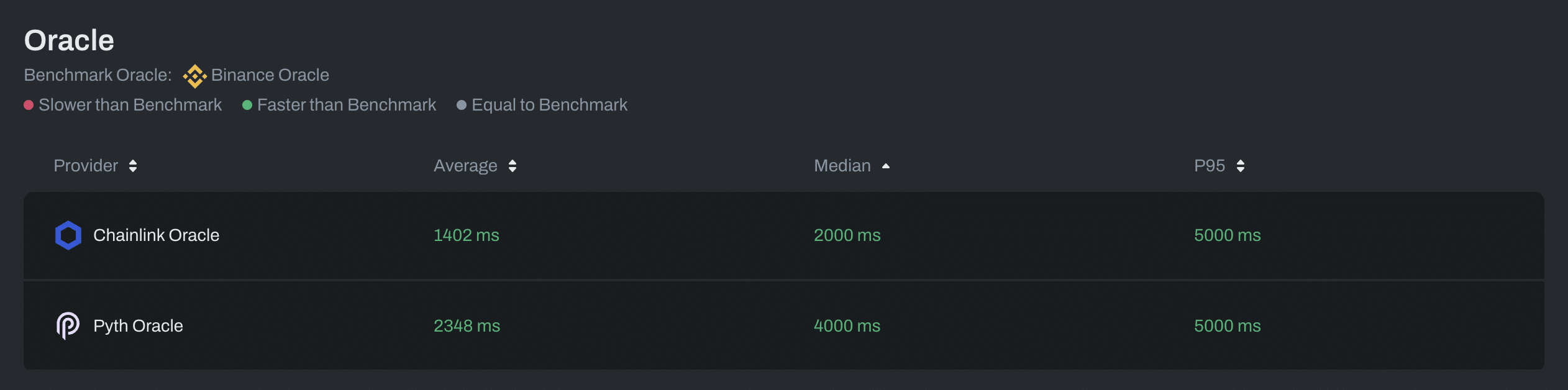

PYTH claims a latency of 400 milliseconds, while Chainlink describes its speed as sub-second without specifying the exact timing. However, data from the Chaos Labs’ oracle dashboard shows a different picture. Over the last 30 days, Chainlink’s average latency was 1,402 milliseconds, whereas PYTH’s average latency was 2,348 milliseconds, making PYTH slower in practice.

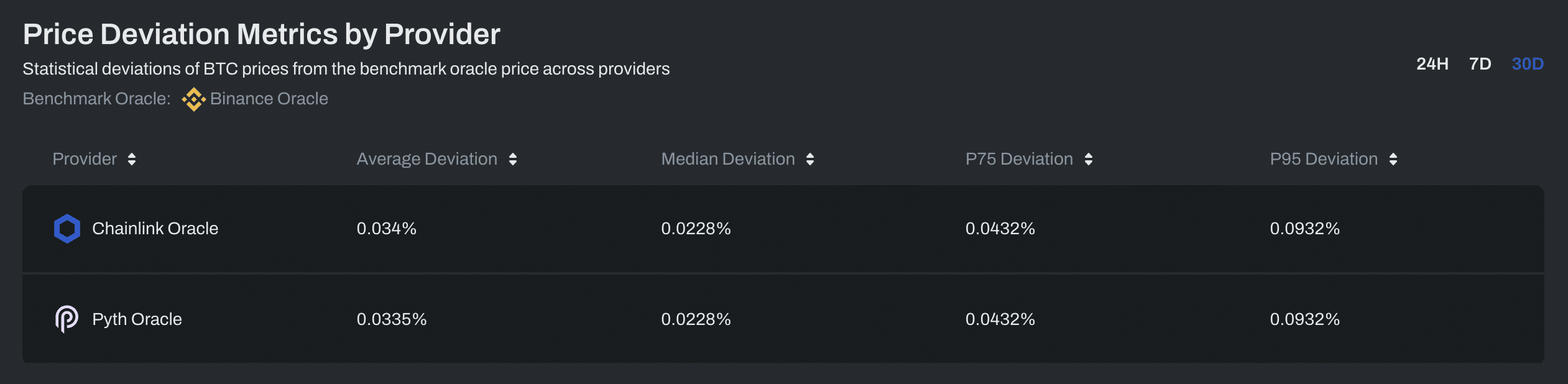

Another important metric is price deviation from the benchmark. For the same period, Chainlink’s average deviation was 0.034%, while PYTH’s was slightly higher at 0.0335%.

This suggests that, despite PYTH’s position on Solana offering theoretical speed advantages, Chainlink’s longer presence in the market has allowed it to optimize performance and maintain a strong position as a reliable oracle provider.

Main Takeaways: PYTH vs. Chainlink

Given the analysis so far, we can highlight several key points:

- PYTH’s supply will remain static at 3,624,988,892 tokens until May 2025, which is likely after the bull market peak.

- Chainlink’s supply is inflationary, with a