This comprehensive guide provides essential insights into investing in cryptocurrencies, focusing on the fundamentals, getting started, staking, and maximizing returns through OkayCoin.

Points

- Understanding the basics of cryptocurrency investment.

- Step-by-step guide to starting with OkayCoin.

- Detailed explanation of staking and its benefits.

- Strategies to maximize returns and minimize risks.

Cryptocurrency is fast becoming a very popular avenue for investment. This new digital money provides users with various means to generate their income by the process of staking. One among the top crypto exchanges, OkayCoin has a wide array of services it offers through its platform, including opportunities for staking and investing.

Understanding the Fundamentals of Cryptocurrency Investment

Before delving deeper into the modalities of investments through OkayCoin, it becomes highly essential to understand the very basics of cryptocurrency and how it works. Cryptocurrencies are digital assets that harness the concept of cryptography to secure their transactions and operate on decentralized networks, mainly based on blockchain technology. Key components include several important factors as mentioned below.

Crypto Assets: These include popularly known digital currencies such as Bitcoin and Ethereum, along with other altcoins and tokens.

Crypto Exchange: This is basically a platform, like OkayCoin, used for buying, selling, and trading of cryptocurrencies.

Getting Started with OkayCoin

OkayCoin provides an easy-to-use platform for both entry-level and experienced investors.

Create an Account: You have to open an account on OkayCoin’s website and verify yourself to align with KYC (Know Your Customer) policies.

Fund Your Account: You can do this in two ways, either you fund your account by depositing Fiat currency, like USD, or you transfer crypto assets you already own into your account from another wallet onto OkayCoin.

Looking at Crypto Assets: Research which cryptocurrencies you might be interested in investing in. Take into consideration the market trends, the likelihood of growth, and what they are used for.

How Staking Works on OkayCoin

Staking is arguably one of the most famous ways to earn passive income in the crypto world. Staking involves participating in the proof-of-stake consensus mechanism by essentially locking up some cryptocurrencies as staked tokens for supporting the security and running of the network, after which you get rewards in return.

Next you can select a staking pool. OkayCoin offers various pools that differ by return and staking period. A staking pool is a way to pool your assets with others to gain the chances of receiving rewards from staking.

Choose a pool that best suits your risk tolerance level and investment goals. After a pool has been chosen, stake the desired amount of cryptocurrency in it. Staking literally locks your assets in the network for some time, which you cannot sell or withdraw within the staking period. Then you can earn rewards. The participants in this staking pool act as validators.

Participants of this pool continuously verify transactions and update the blockchain. The rewards for all this process are distributed among the participants proportionally to the stake.

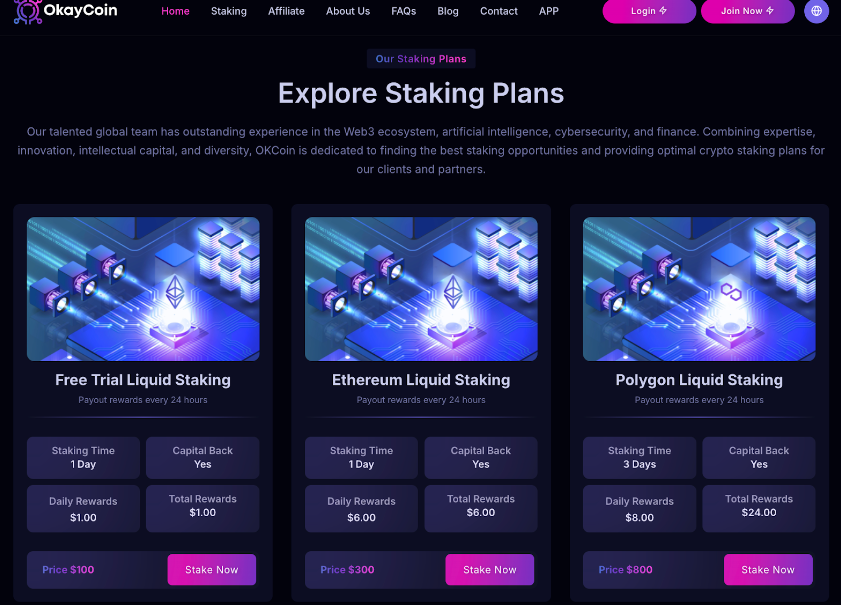

- Free Trial Staking Plan: $100 for 1 day and earn $1 daily.

- Ethereum Staking Plan: $300 for 1 day and earn $6 daily.

- Polygon Staking Plan: $800 for 3 days and earn $8 daily.

- TRON Staking Plan: $1200 for 7 days and earn $12 daily.

- Polkadot Staking Plan: $3000 for 7 days and earn $33 daily.

- Celestia Staking Plan: $6000 for 14 days and earn $72 daily.

- Aptos Staking Plan: $10,000 for 15 days and earn $140 daily.

- Sui Staking Plan: $20,000 for 15 days and earn $280 daily.

- Avalanche Staking Plan: $35,000 for 20 days and earn $525 daily.

- Cardano Staking Plan: $56,000 for 30 days and earn $896 daily.

- Solana Staking Plan: $78,000 for 30 days and earn $1,404 daily.

- Ethereum Staking Plan Pro: $100,000 for 45 days and earn $2,000 daily.

Maximizing Returns Through Staking

Monitor Staking Yield: Follow up on the several pools’ staking yields. Yields are dynamic, as this depends on how the network is performing at that time and according to market conditions. Make adjustments accordingly to get better returns.

Leverage Delegated Staking: Those who are hands-off investors, OkayCoin has got delegated staking options. This will keep you hands-off by simply delegating your staking power to professional validators who manage the staking work on your behalf.

Stay updated: The crypto market is very dynamic. Stay up-to-date on the latest news, technology developments, and regulatory changes that may affect your investments.

Additional Investment Opportunities on OkayCoin

Besides staking, OkayCoin has other investment opportunities. Referral Program is one of the best investment opportunities for its users. In Referral Program, you can invite more users to OkayCoin and earn some rewards in return. You will share your unique referral link and then get some commission on the trading fees that they generate.

Risks and Considerations

While investing in crypto is substantially potential-laden in returns, it is equally important to notice the associated risks. Digital asset prices are very volatile. Be prepared for extreme swings in prices that may impact your investment’s value. Security Risks are another considerable factor. Using secure wallets and adhering to the best practices in securing assets against hacks or scams is important. There are some regulatory risks as well. Regulatory environments around cryptocurrencies are still unfolding. Changes in laws and regulations can have an effect on the market and your investments.

Conclusion

If you want to be successful in this sector, you will have to know the basics of cryptocurrency, how staking works, and some strategies to maximize returns. Having said that, you will have to update yourself regarding the associated risks so that you can make an informed decision while investing in the field.

解説

- Staking: A process where crypto holders participate in the operation of a blockchain network by locking up their tokens, earning rewards.

- Proof-of-Stake (PoS): A consensus mechanism used by blockchain networks where validators are chosen based on the number of tokens they hold and are willing to “stake” as collateral.

- Fiat currency: Government-issued currency, such as USD, that is not backed by a physical commodity but rather by the government that issued it.

- KYC (Know Your Customer): A process used by financial institutions to verify the identity of their clients to prevent fraud and comply with legal regulations.

Investing in cryptocurrency involves understanding the basics, selecting the right platform, and choosing appropriate investment strategies like staking. By leveraging the features offered by platforms like OkayCoin and staying informed about market trends and regulatory changes, investors can maximize their returns and manage risks effectively. Always consider the associated risks and ensure you have a well-diversified portfolio to mitigate potential losses.