Examines the potential outcomes of an emergency Federal Reserve meeting where a 50 basis point interest rate cut is anticipated to address global market turmoil.

Points

- Impact of Japan’s yen crash and global market reactions.

- Predictions on the Federal Reserve’s potential rate cut.

- Analysis of crypto market conditions amid traditional market turmoil.

- Insights from financial experts on the

Emergency FED Meeting: Will a 50 Basis Point Cut Save the $13 Trillion Market from Collapse?

-

– title start — Emergency FED Meeting: Will a 50 Basis Point Cut Save the $13 Trillion Market from Collapse? — title end —

-

– start content —

Examines the potential outcomes of an emergency Federal Reserve meeting where a 50 basis point interest rate cut is anticipated to address global market turmoil.

Points

- Impact of Japan’s yen crash and global market reactions.

- Predictions on the Federal Reserve’s potential rate cut.

- Analysis of crypto market conditions amid traditional market turmoil.

- Insights from financial experts on the rate cut implications.

Introduction

The U.S. Federal Reserve (FED) has called an emergency meeting in response to the current financial chaos affecting global markets. Speculation is rife that a 50 basis point interest rate cut may be on the horizon to prevent further economic decline. This article delves into the potential impacts of this anticipated decision.

Impact of Japan’s Yen Crash

The global financial instability has been significantly influenced by Japan’s recent decision to raise interest rates, which has led to a 13% crash in the yen. This move has had a domino effect on other Asian currencies, with Korea and Taiwan’s currencies dropping by 10% each. The resulting market panic has also affected the cryptocurrency sector, with Bitcoin plummeting by 21% and S&P futures falling by 4%.

Anticipated FED Response

With the emergency FED meeting looming, market analysts predict a 50 basis point rate cut. This preemptive move is seen as a measure to halt the financial freefall. Economist Peter Schiff, however, warns that such a cut could push the U.S. into a recession, making it a double-edged sword.

Crypto Market Turmoil

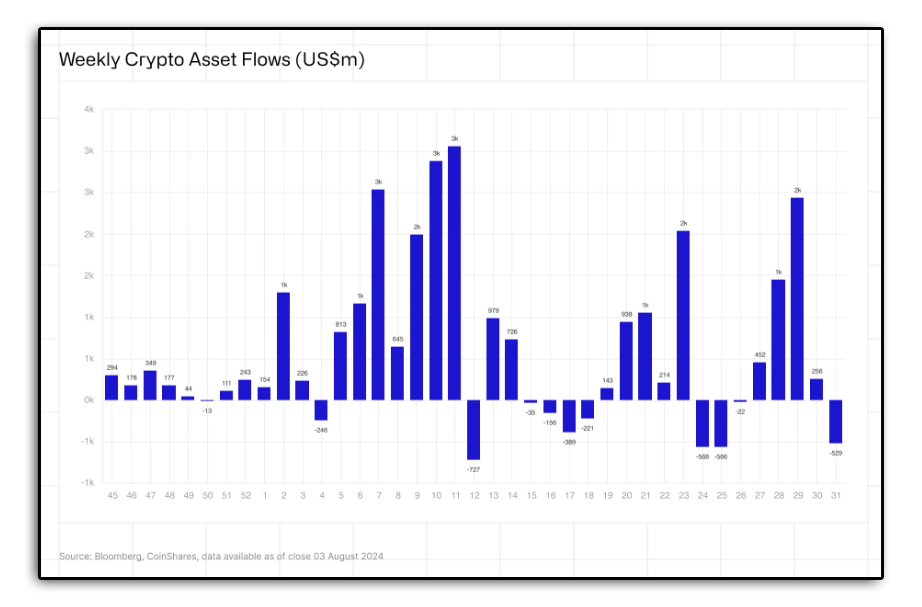

The crypto market has not been immune to the broader financial turmoil. CoinShares reported a staggering $529 million outflow from crypto products last week, driven by recession fears and market instability. Bitcoin saw $400 million in outflows, while Ethereum experienced $146 million in redemptions.

Institutional Reactions

Despite the market chaos, some large financial institutions, including BlackRock, MicroStrategy, and Fidelity, have not sold their Bitcoin holdings, indicating a long-term bullish outlook. Capula Management also reported $500 million in Bitcoin ETF holdings, suggesting confidence in a market recovery.

Broader Market Conditions

Several factors have contributed to the current market downturn:

– Recession Fears: Concerns about a looming U.S. recession.

– Stock Market Correction: Sharp declines in stock markets.

– Geopolitical Tensions: Rising geopolitical instability.

– Monetary Policy Changes: The impact of Japan’s rate hike and the U.S. Federal Reserve’s stance on interest rates.

“Reasons why crypto is crashing:

– Trump presidency odds decreasing

– Recession fears

– Stock market correction

– Yen unwind

– Geopolitical tensions

– Jump unwinding positions

– Gox distributions

– Recent pump trapped fresh longs

– Altcoin dispersion

Perfect storm.”

https://twitter.com/milesdeutscher/status/1820128964850958385

The anticipated 50 basis point rate cut by the FED is a critical move aimed at stabilizing the global financial markets. However, the potential for unintended consequences, such as pushing the U.S. into a recession, cannot be overlooked. As the markets remain volatile, both traditional and crypto investors must stay vigilant and prepared for further fluctuations.

解説

- Basis Point: A unit of measurement for interest rates and other percentages in finance. One basis point is equal to 0.01%.

- Monetary Policy: Actions by a central bank to control the money supply and interest rates in the economy.

- Recession: A period of temporary economic decline, typically defined by a fall in GDP in two successive quarters.

Understanding the implications of the FED’s decisions on interest rates is crucial for investors. While a rate cut may provide short-term relief, the long-term effects on the economy and financial markets need careful consideration. Staying informed and adaptable to changing market conditions is key to navigating this period of uncertainty.