This article examines the recent billion-dollar crypto crash in the context of the Japanese market collapse, analyzing the factors behind the downturn and exploring potential future developments.

Points

- Overview of the billion-dollar crypto crash and Japanese market collapse.

- Analysis of the contributing factors.

- Impact on global markets and cryptocurrencies.

- Predictions for future market movements.

Billion-Dollar Crypto Crash Combined with Japanese Market Collapse – What’s Next?

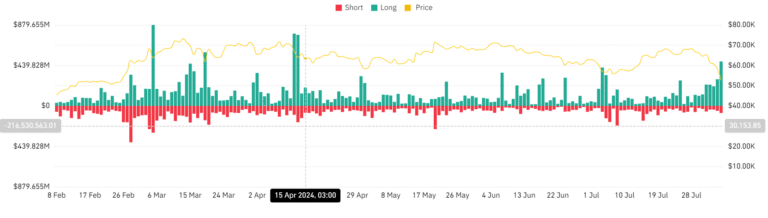

The crypto market has experienced a significant downturn, resulting in a liquidation of 1 billion dollars in just 24 hours. This recent crash has caused concern and prompted analysts to look at the underlying causes.

Impact of the Japanese Stock Market on Cryptocurrencies

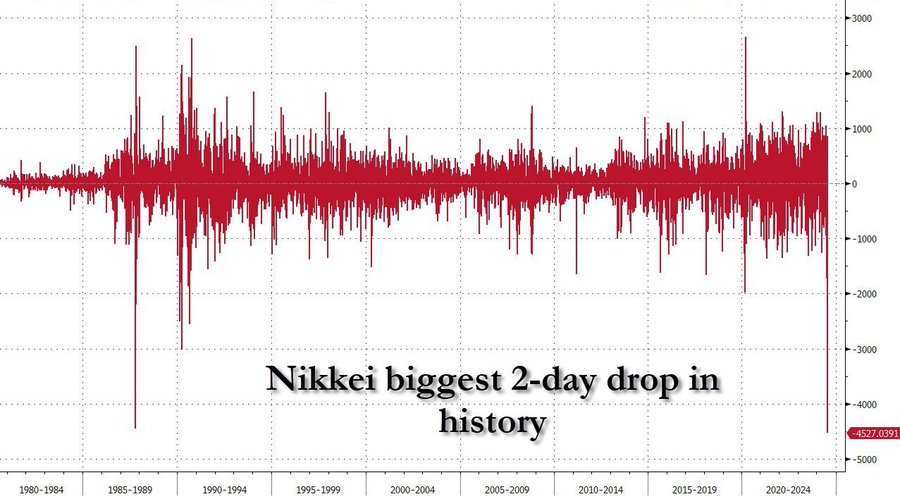

The Japanese stock market experienced the worst two-day plunge in recent history, surpassing even the infamous Black Monday crash of 1987.

Japanese stocks (Nikkei 225) plunging over 25% from their highs to 30,900 support. If this support can hold, then could be a nice bounce coming

Jap stocks are crashing for two reasons

[Source](https

://twitter.com/adamkhootrader/status/1820343807097160052)

Source: X

Traders who had previously bought yen at low prices to leverage their positions are now facing losses. This has also led to extensive selling in cryptocurrencies. Adam Khoo, a well-known market analyst, pointed out that the Nikkei 225 index has slumped by more than 25% and tested a critical support level at 30,900 points.

Source: Tradingview

The Bank of Japan’s decision to raise interest rates to curb inflation and the stronger yen making Japanese exports less competitive have added to market fears and contributed to the sell-off in other markets, including Taiwan and South Korea.

Geopolitical Tensions Fuel Market Fears

Geopolitical unrest, particularly in the Middle East, has also played a key role in the recent volatility of crypto markets. The assassination of a Hamas leader by Israel and subsequent military activity in Lebanon has fueled fears of a wider regional conflict.

Market Uncertainty Following US Federal Council Decisions

Source: Coinglass

Rumors that the Fed may cut interest rates to mitigate the impact of the Japanese market downturn have added to the uncertainty and triggered further liquidation in the crypto sector.

Future Outlook

The combination of the Japanese stock market collapse and the billion-dollar crypto crash has created a highly volatile and uncertain market environment. Analysts are closely watching for any signs of stabilization or further declines.

Predictions for Future Market Movements

Given the current conditions, the market is likely to experience continued volatility. Key factors to watch include further central bank actions, geopolitical developments, and investor sentiment. While there may be opportunities for short-term gains, the overall market environment remains precarious.

解説

- Market Volatility: The recent crash highlights the interconnectedness of global markets and the impact of major economic events on the crypto sector.

- Geopolitical Influence: Heightened geopolitical tensions can exacerbate market volatility, affecting investor confidence and leading to significant price fluctuations.

- Central Bank Actions: Decisions by central banks, such as interest rate changes, play a crucial role in market dynamics, influencing both traditional and crypto markets.

- Investment Strategies: In such a volatile environment, investors should adopt cautious strategies, closely monitor market trends, and consider diversification to mitigate risks.