Cardano (ADA) has seen a sharp decline, marking its most significant three-day sell-off since the 2022 bear market. The recent drop poses challenges for ADA, with key support levels under threat and bearish trends indicated by market data.

Points

- ADA experiences the most significant three-day sell-off since 2022.

- Data shows a disparity between profitable and loss-making addresses.

- ADA’s $0.30 support level is at risk, with potential drops to $0.28.

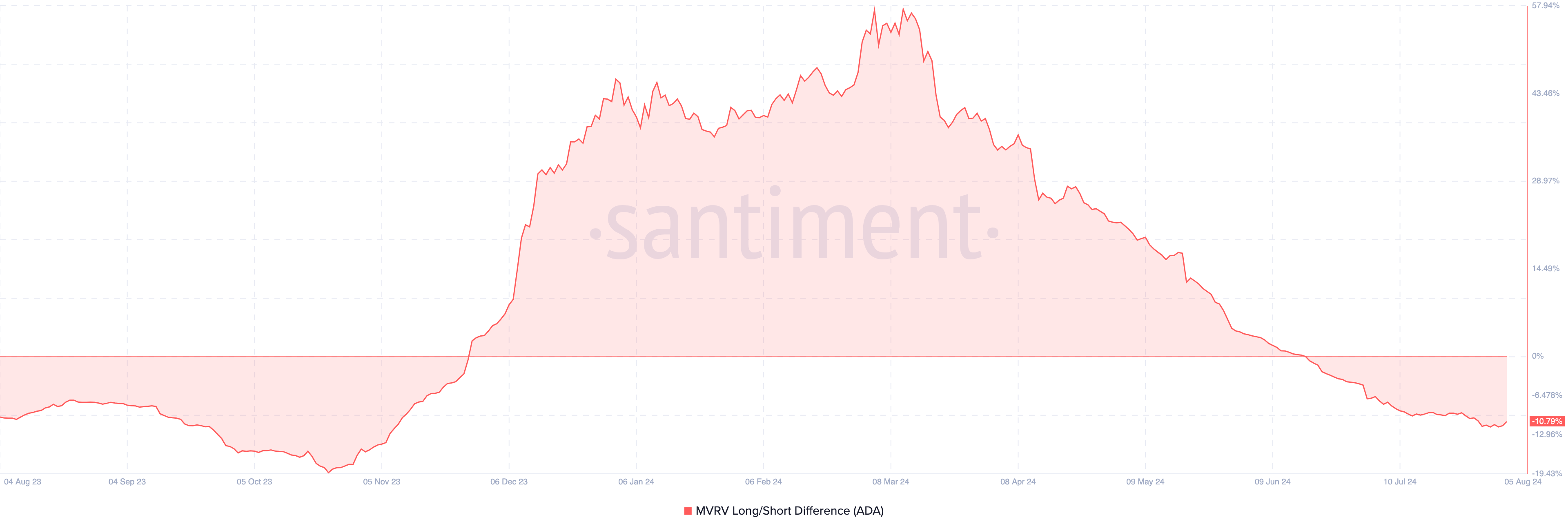

- Market Value to Realized Value (MVRV) suggests a bearish trend.

- Key technical indicators point to further declines.

Cardano (ADA) has been hit hard by a sharp decline, marking its most significant three-day sell-off since the 2022 bear market. While Cardano has the potential to recover, data from OMAP suggests that the path to recovery is fraught with challenges. The IOMAP data categorizes addresses based on profits, losses, and thresholds at various price ranges, revealing the strength of support or resistance at different levels.

Will ADA Maintain Support at $0.30?

The disparity between addresses at a profit and those at a loss suggests that Cardano might struggle to maintain its $0.30 support level. If this support fails, ADA could experience another decline, potentially falling to $0.28. Additionally, the Market Value to Realized Value (MVRV) Long/Short Difference, recorded at -10.79%, indicates that long-term holders are currently less profitable than short-term holders, suggesting a bearish trend.

ADA Chart Analysis

Since August 2, multiple sell signals have appeared on Cardano’s daily chart, accelerating its decline. The Supertrend indicator, which generates buy and sell signals, was above ADA when the price was $0.42, indicating a sell signal. Similarly, the Parabolic Stop and Reverse (SAR), another directional indicator, showed a sell signal when ADA was trading at $0.42, with dotted lines positioned above the price.

Actionable Insights

- Monitor ADA’s support levels closely, especially around $0.28 to $0.30.

- Watch for sell signals on ADA’s daily chart, specifically from indicators like Supertrend and Parabolic SAR.

- Consider the disparity in the number of profitable addresses versus those at a loss for deeper market insights.

The current market structure indicates weakness, suggesting that ADA may face further corrections. The Fibonacci retracement technique, which uses percentages to identify support and resistance points, reinforces this prediction. ADA’s price is below the 23.6% nominal retracement, signaling bear dominance. If selling pressure mounts, the cryptocurrency’s value could drop to the $0.27 level.

解説

- Cardano’s sharp price decline highlights significant market challenges and weak support.

- The disparity in the number of profitable vs. loss-making addresses suggests potential further declines.

- Technical indicators like Supertrend and Parabolic SAR point to bearish trends.

- The Fibonacci retracement technique confirms bear dominance, with potential drops to $0.27.

- Investors should monitor key support levels and market indicators closely to navigate potential declines.