VeChain (VET) is positioned as a leader in blockchain-based solutions for supply chain transparency and product authentication. Despite market volatility, VeChain has demonstrated resilience, making it a promising candidate for long-term growth. This article provides an in-depth analysis of VeChain’s price predictions from 2024 to 2030, considering various market dynamics and technical factors.

Points

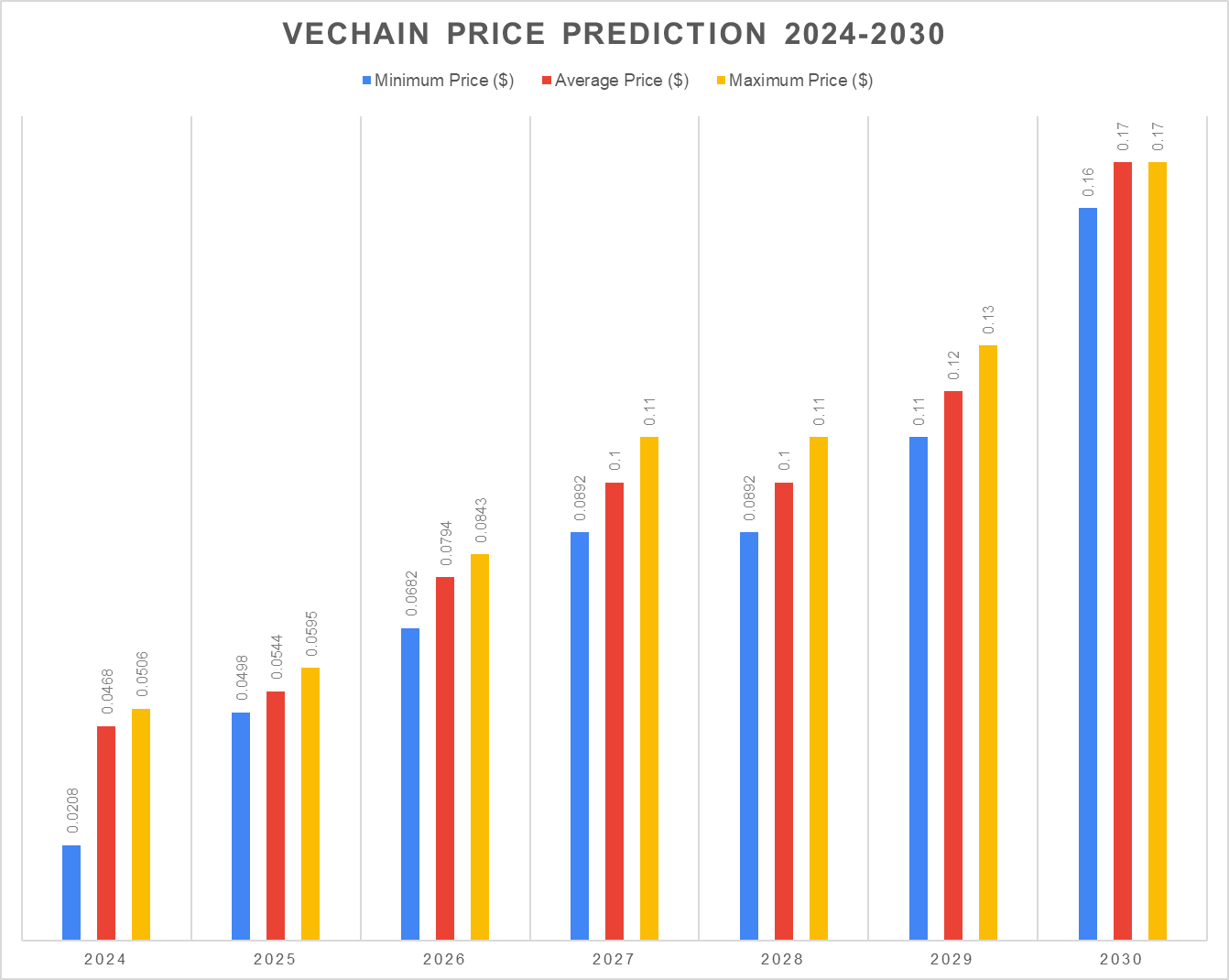

- VeChain’s price could reach $0.0506 by December 2024.

- The price may rise to a range between $0.0892 and $0.11 by 2027.

- By 2030, VeChain’s price could surge to $0.17.

- The article discusses the importance of VeChain’s role in supply chain transparency and its potential impact on long-term value.

VeChain (VET) has established itself as a significant player in the blockchain space, particularly in supply chain management and enterprise solutions. The platform’s focus on providing transparency, traceability, and data integrity across various industries has positioned it as a valuable tool for businesses seeking to enhance their operations. With the growing adoption of blockchain technology, VeChain’s market outlook remains optimistic, and its price predictions for the coming years reflect this potential.

As of 2024, VeChain’s price prediction suggests that VET could reach a peak of $0.0506 by December. This growth is expected to be driven by increasing adoption of VeChain’s solutions across various sectors, including logistics, food safety, and luxury goods. The platform’s partnerships with major corporations, such as DHL, continue to validate its utility and relevance in the global market.

Looking ahead to 2027, analysts predict that VET could trade between $0.0892 and $0.11. This forecast is supported by the ongoing development of VeChain’s ecosystem and the expansion of its use cases. As more industries recognize the benefits of blockchain for supply chain management, VeChain is likely to see increased demand, driving up the token’s value.

By 2030, VeChain’s price could potentially surge to $0.17, representing significant growth from its current levels. This long-term prediction is based on the assumption that VeChain will continue to innovate and expand its offerings, cementing its position as a leader in the blockchain space. Additionally, the broader adoption of blockchain technology across industries is expected to provide a favorable environment for VeChain’s continued growth.

VeChain’s historic price sentiment also plays a role in shaping future expectations. Since its inception in 2015, VeChain has experienced various market cycles, including rapid growth periods and corrections. Despite these fluctuations, the platform has consistently demonstrated its ability to recover and grow, which bodes well for its future prospects.

For investors, VeChain presents an attractive opportunity due to its strong focus on real-world applications and its potential to disrupt traditional supply chain management. However, it’s essential to consider the inherent risks associated with the cryptocurrency market, including regulatory challenges and market volatility. Conducting thorough research and staying informed about market trends will be crucial for those looking to invest in VET.

解説

- VeChain’s potential for growth is strongly tied to its ability to solve real-world problems, particularly in supply chain management. The platform’s focus on transparency and product authentication provides a compelling value proposition for businesses looking to improve operational efficiency.

- The projected price increase over the next decade is based on several factors, including the expansion of VeChain’s partnerships and the broader adoption of blockchain technology. These elements are likely to drive demand for VET, contributing to its long-term value.

- Investors should remain aware of the risks associated with investing in cryptocurrencies, such as regulatory changes and market volatility. However, VeChain’s strong use cases and growing adoption suggest that it has a solid foundation for future growth.

- As VeChain continues to evolve, monitoring its development and market trends will be essential for making informed investment decisions. The platform’s ability to innovate and adapt to changing market conditions will play a crucial role in determining its success in the coming years.