Coinbase has launched a fresh challenge against the U.S. Securities and Exchange Commission (SEC) regarding its proposed new rule that seeks to redefine what constitutes a national securities exchange. The crypto exchange argues that the SEC’s approach is flawed, lacking sufficient information to justify the regulatory changes and potentially stifling innovation in the burgeoning decentralized finance (DeFi) space.

Points

- Coinbase Pushback: Coinbase disputes the SEC’s proposed rule change, claiming it could harm the DeFi ecosystem.

- Flawed Analysis: The crypto exchange criticizes the SEC for not conducting a proper cost-benefit analysis.

- Potential Impact: The proposed rule could redefine exchanges to include decentralized exchanges (DEXs), raising industry concerns.

Coinbase, one of the largest cryptocurrency exchanges in the world, is once again at odds with the U.S. Securities and Exchange Commission (SEC) over its latest proposed rule change. The rule in question seeks to redefine what constitutes a national securities exchange, a move that Coinbase argues could have far-reaching implications for the crypto industry, particularly the decentralized finance (DeFi) sector.

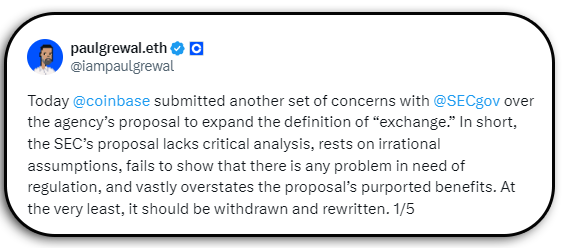

In its third comment letter to the SEC, Coinbase Chief Legal Officer Paul Grewal laid out the exchange’s concerns, highlighting what it views as serious flaws in the SEC’s approach. According to Grewal, the SEC has not conducted a thorough cost-benefit analysis, which is essential for understanding the potential impact of the rule change. Instead, Coinbase claims that the SEC is relying on assumptions and incomplete data, making it impossible to gauge the true costs and benefits of the proposal.

“It is accordingly impossible to see how the Commission could possibly have discharged its statutory and procedural obligations to regulate in light of the best available information when the Commission admits that on many key issues it has little or no information at all,” wrote Grewal.

The proposed rule change by the SEC could have significant implications for decentralized exchanges (DEXs), potentially bringing them under the same regulatory umbrella as traditional securities exchanges. This redefinition could impose new compliance burdens on DEXs, which operate in a fundamentally different manner from centralized exchanges.

The Core of Coinbase’s Argument

Coinbase’s primary contention is that the SEC’s proposal is not only premature but also potentially harmful to the development of the DeFi sector. The exchange points out that the SEC’s current rules are designed for traditional financial markets and do not account for the unique nature of blockchain technology and decentralized networks. Applying these rules to DEXs could stifle innovation, driving developers and projects away from the U.S. to more crypto-friendly jurisdictions.

Furthermore, Coinbase argues that the SEC’s lack of a clear definition for what constitutes a crypto asset security adds to the confusion. Without this clarity, the proposed rule could inadvertently ensnare a wide range of digital assets and platforms that were never intended to be regulated as securities exchanges.

Potential Industry Impact

The SEC’s proposed rule change is part of a broader regulatory push to bring more oversight to the rapidly growing crypto industry. However, Coinbase and other industry stakeholders warn that such regulations, if not carefully crafted, could have the opposite effect, pushing innovation out of the U.S. and into countries with more supportive regulatory environments.

This ongoing battle between Coinbase and the SEC is emblematic of the larger struggle between regulators and the crypto industry. While there is a general consensus on the need for some level of regulation to protect investors and maintain market integrity, the challenge lies in crafting rules that do not stifle the very innovation that makes the crypto industry so dynamic.

###解説

-

Regulatory Challenges: The SEC’s attempt to redefine exchanges to include decentralized exchanges (DEXs) reflects the agency’s broader efforts to bring more of the crypto industry under its regulatory purview. However, this move has sparked significant pushback from the industry, which fears that such regulation could hinder innovation and drive crypto businesses out of the U.S.

-

Cost-Benefit Analysis: A key criticism from Coinbase is the SEC’s failure to conduct a proper cost-benefit analysis. Such an analysis is crucial in understanding the full impact of new regulations, especially in a fast-evolving space like cryptocurrency. Without it, there is a risk that regulations could impose unnecessary burdens on the industry without delivering commensurate benefits.

-

Future Implications: The outcome of this dispute could set a significant precedent for how the crypto industry is regulated in the future. If the SEC moves forward with its proposal, it could lead to more stringent oversight of decentralized platforms, potentially reshaping the landscape of the DeFi sector. Conversely, a successful challenge by Coinbase could force regulators to take a more nuanced approach to crypto regulation, balancing innovation with investor protection.