The market for liquidity restaking tokens has surged by 8,300% due to high demand for efficient financial instruments

The market for liquidity restaking tokens (LRTs) has surged by 8,300% due to increasing demand for efficient and user-friendly financial instruments in the DeFi space.

Points

- LRT market value has increased by 8,300% since the beginning of the year.

- Major liquid restaking protocols are capitalizing on technical arbitrage opportunities.

- Node Capital’s analyst highlights the importance of sophisticated operator infrastructure.

- Growing adoption of LRTs reflects their efficiency and user-friendliness.

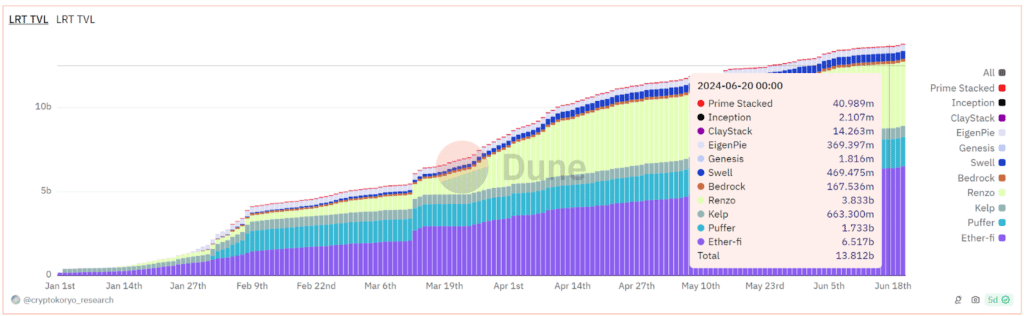

As investors seek efficient financial instruments, the total locked value in liquidity restaking tokens (LRTs) has soared by more than 8,000% since the beginning of the year.

The total value locked in liquid restaking tokens | Source: Dune

Protocols Capitalize on Arbitrage Opportunity

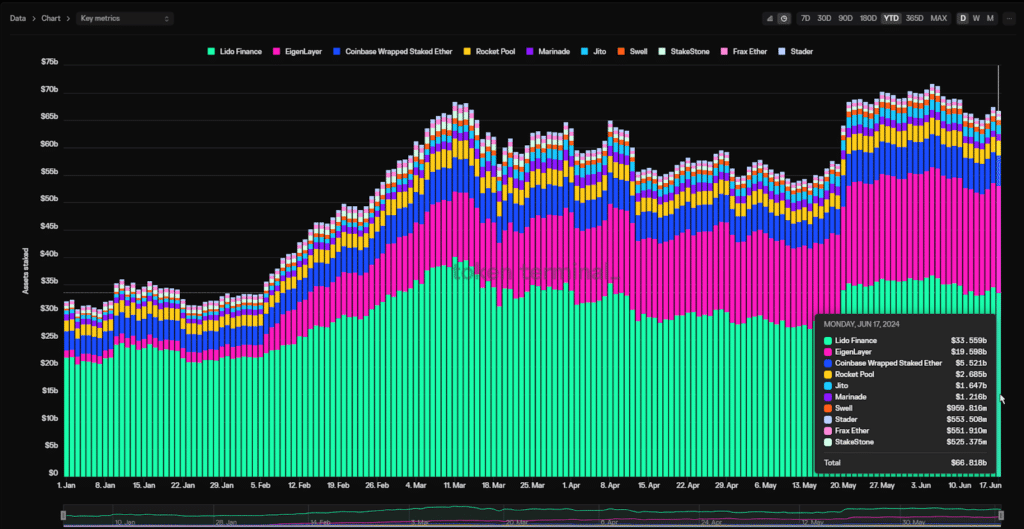

Node Capital’s token engineering analyst Or Harel suggests that the dramatic rise in LRT adoption can be attributed to the fact that major liquid restaking protocols noticed the hype and “capitalized on this technical arbitrage opportunity.”

Liquid staking protocols by their market share | Source: crypto.news

“In a short period, these LRPs accumulated billions in stakers’ capital and built sophisticated operator infrastructure, positioning themselves as key facilitators of the supply side,” he added.

Efficiency and User-Friendliness Drive Adoption

The surge in the LRT market highlights the increasing demand for financial instruments that offer both efficiency and user-friendliness. Liquidity restaking tokens provide a streamlined way for investors to maximize their returns by restaking their liquid staking assets. This process enhances capital efficiency and creates new earning opportunities in the DeFi ecosystem.

LRTs have become a popular choice for DeFi investors due to their ability to unlock additional liquidity and generate higher yields. By restaking liquid staking tokens, investors can participate in multiple DeFi protocols, further optimizing their returns.

Key Factors Behind the Growth

Several factors contribute to the rapid growth of the LRT market:

- Increased Demand for Yield-Generating Assets: As DeFi continues to evolve, investors are constantly seeking new ways to generate passive income. LRTs offer an attractive solution by allowing users to earn rewards from multiple protocols simultaneously.

- Improved Infrastructure: The development of sophisticated operator infrastructure by major liquid restaking protocols has facilitated the seamless integration of LRTs into the DeFi ecosystem. This infrastructure ensures efficient and secure transactions, boosting investor confidence.

- Technical Arbitrage Opportunities: Major protocols have successfully identified and leveraged technical arbitrage opportunities, further driving the adoption of LRTs. These opportunities enable investors to capitalize on market inefficiencies and maximize their returns.

Future Prospects

The continued growth of the LRT market is expected to have a significant impact on the DeFi landscape. As more investors recognize the benefits of liquidity restaking tokens, the demand for these instruments is likely to increase further. This trend will drive innovation and competition among DeFi protocols, leading to the development of more advanced and user-friendly financial instruments.

The success of LRTs also underscores the importance of efficient capital management in the DeFi ecosystem. By unlocking additional liquidity and optimizing returns, LRTs contribute to the overall growth and sustainability of decentralized finance.

解説

- The LRT market’s impressive growth reflects the increasing demand for efficient and user-friendly financial instruments in DeFi.

- Key factors behind this growth include improved infrastructure, technical arbitrage opportunities, and the demand for yield-generating assets.

- The future prospects for LRTs are promising, with continued innovation and competition expected to drive further adoption and market expansion.