Litecoin (LTC) has seen a significant rise in whale activity, with large transactions and reduced miner reserves. This article examines the implications of these developments for LTC’s price and future prospects.

Points

- Whale transactions involving over $1 million in LTC have surged by 111% in 24 hours.

- Miner reserves of LTC have dropped to a one-month low, indicating higher demand and reduced supply.

- LTC’s price has risen by 1.77% to $70.34 with a daily transaction volume of $288.54 million.

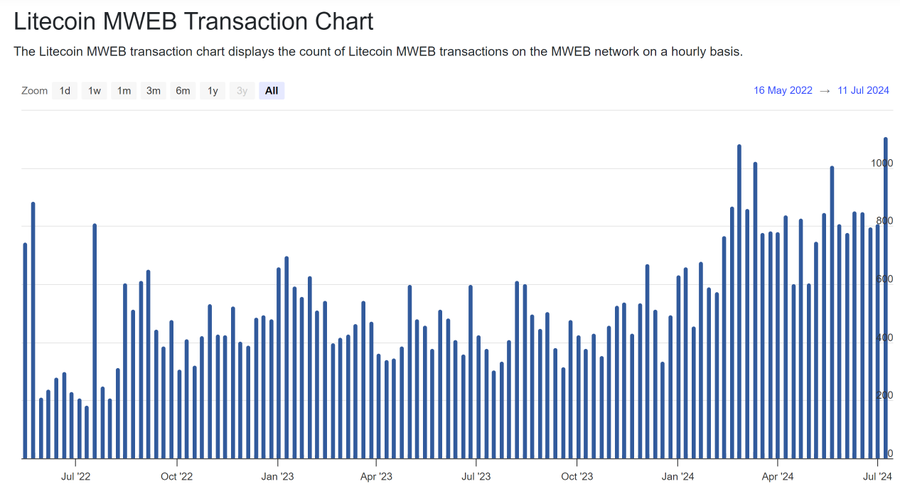

- Activity on Litecoin’s MimbleWimble Extension Block (MWEB) is at an all-time high.

- The decrease in miner reserves suggests potential for price appreciation due to increased demand.

Litecoin (LTC) has experienced a notable surge in whale activity, with large transactions and reduced miner reserves signaling a potential shift in the market dynamics for LTC. According to data from IntoTheBlock, whale transactions involving over $1 million in LTC have surged by 111% in just the past 24 hours. This spike in whale activity indicates heightened interest and confidence in Litecoin among large-scale investors.

Simultaneously, miner reserves of LTC have dropped to a one-month low, suggesting a reduction in supply. This decrease in miner reserves is often a bullish indicator, as it typically reflects higher demand for the cryptocurrency. The reduced supply, coupled with increased demand, can contribute to upward price pressure.

Amid these developments, the price of LTC has risen by 1.77% over the last 24 hours, reaching $70.34 with a daily transaction volume of $288.54 million. This price increase aligns with the growing whale activity and decreased miner reserves, underscoring the positive sentiment surrounding Litecoin.

MimbleWimble Extension Block (MWEB) Activity

Furthermore, activity on Litecoin’s MimbleWimble Extension Block (MWEB) is at all-time highs. Both MWEB-specific transactions and balances have increased over the past year. MWEB, Litecoin’s optional fungibility and scalability update, is gaining traction, offering enhanced privacy features. When users utilize MWEB, their transaction details are obscured, adding a layer of privacy and security.

The growing adoption of MWEB indicates that users are increasingly valuing privacy and scalability in their transactions. This trend is likely to bolster Litecoin’s attractiveness as a payment method and store of value.

Implications for LTC’s Future

The surge in whale activity and the drop in miner reserves suggest potential for price appreciation for Litecoin. As large-scale investors continue to show interest and miner reserves remain low, the supply-demand dynamics are likely to favor further price increases. Additionally, the increasing adoption of MWEB enhances Litecoin’s utility and appeal, contributing to its long-term prospects.

Market analysts remain optimistic about Litecoin’s future, citing the cryptocurrency’s strong fundamentals and growing adoption. As the broader crypto market recovers, Litecoin is positioned as a key player to watch.

Conclusion

Litecoin’s significant rise in whale activity and reduced miner reserves indicate a bullish outlook for LTC. The growing adoption of the MimbleWimble Extension Block further strengthens Litecoin’s position in the market. Investors should monitor these developments closely, as the supply-demand dynamics and enhanced privacy features suggest potential for continued price appreciation.

解説

- The surge in whale activity and drop in miner reserves are bullish indicators for Litecoin.

- Increased demand and reduced supply create upward price pressure for LTC.

- The MimbleWimble Extension Block enhances Litecoin’s utility with privacy and scalability features.

- Market analysts are optimistic about Litecoin’s future, citing strong fundamentals and growing adoption.

- Investors should keep an eye on these trends to capitalize on potential price increases for LTC.