An in-depth analysis of the current state of Arbitrum (ARB), the challenges it faces, and its future prospects in the cryptocurrency market.

Points

- 97% of Arbitrum holders are experiencing losses.

- Arbitrum’s trading volume and token value have significantly declined.

- Comparison with other Ethereum Layer 2 solutions.

- Potential recovery strategies and future outlook for ARB.

- Importance of investor sentiment and market trends.

Arbitrum (ARB), a prominent Ethereum Layer 2 solution, has been underperforming, with a staggering 97% of its holders currently in loss. This decline raises concerns about its future and the overall health of its ecosystem.

ARB Token Decline

Since its token launch in January 2023, Arbitrum has struggled to maintain investor interest. Data from Messari reveals that the ARB token has been on a continuous downward trend, with only three months of slight gains between October 2023 and January 2024. The token has plummeted nearly 76% from its all-time high of $2.39 in January 2024.

The Scary Data

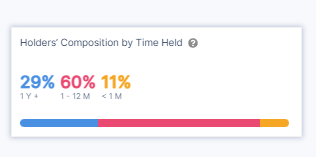

According to IntoTheBlock, only 0.02% of ARB holders are in profit, while 97% are in loss. This widespread loss among holders indicates significant challenges within the Arbitrum ecosystem. Additionally, only 29% of holders have held ARB for more than a year, with the majority holding for less than a month.

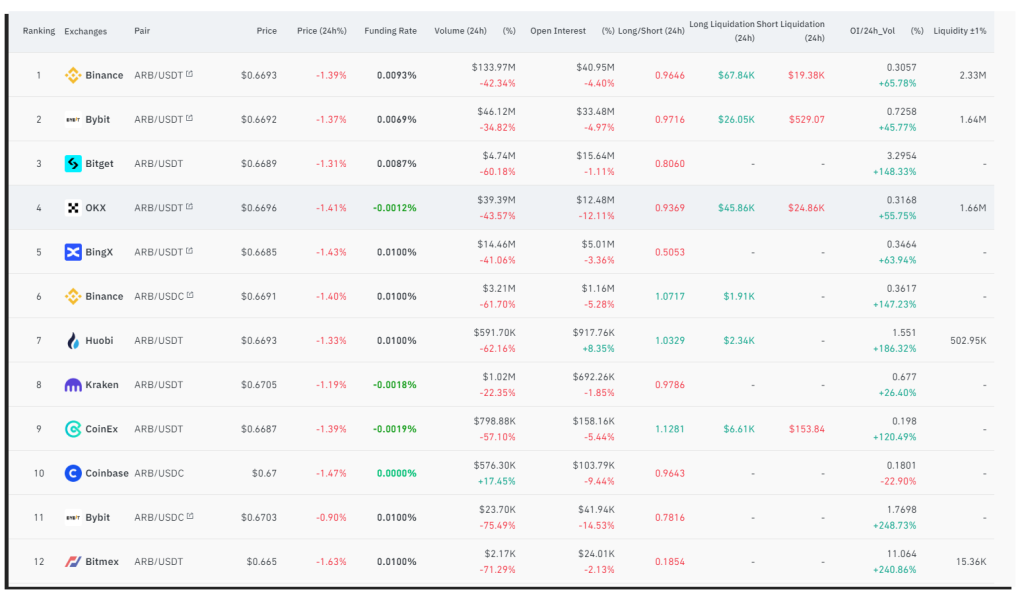

Decline in Trading Volume

Glassnode data shows a marked decline in ARB token trading volume over the past 24 hours, further highlighting the dwindling investor interest. The initial excitement surrounding Arbitrum’s airdrop and DApps has not sustained its market value.

Comparison with Other Layer 2 Solutions

Compared to other Ethereum Layer 2 solutions, Arbitrum has seen less success. The ecosystem has faced several hurdles, including network congestion and high gas fees, which have impacted its performance.

Future Outlook

To recover, Arbitrum needs to focus on enhancing its technology, reducing transaction costs, and improving user experience. Building a robust ecosystem with diverse DApps and strong community support will be crucial. Additionally, effective marketing strategies and partnerships can help regain investor confidence.

Conclusion

Arbitrum’s current state is challenging, with a significant portion of its holders in loss and declining trading volumes. However, with strategic improvements and renewed focus on user experience and ecosystem development, there is potential for recovery. Investors should monitor market trends and Arbitrum’s efforts to address these issues closely.

解説

- Challenges and Opportunities: Arbitrum faces significant challenges with a high percentage of holders in loss and declining trading volumes. However, focusing on technology improvements, user experience, and strategic partnerships can create opportunities for recovery.

- Investor Sentiment: Understanding the factors influencing investor sentiment, such as network performance and transaction costs, is crucial for Arbitrum’s future success.

- Strategic Improvements: Enhancing the Arbitrum ecosystem through innovative DApps, community engagement, and effective marketing strategies can help regain investor confidence and drive future growth.