Bitcoin(BTC)faces a critical juncture as it approaches key supportlevels,with market sentiment and technical indicators suggesting potential furtherdeclines.

Points

- OverviewofBitcoin’srecentpricemovements.

- KeysupportandresistancelevelsforBTC.

- Marketsentimentandtechnicalanalysis.

- PotentialscenariosforBTC’spriceintheshortterm.

- Broaderimplicationsforthecryptocurrencymarket.

OverviewofBitcoin’sRecentPriceMovements

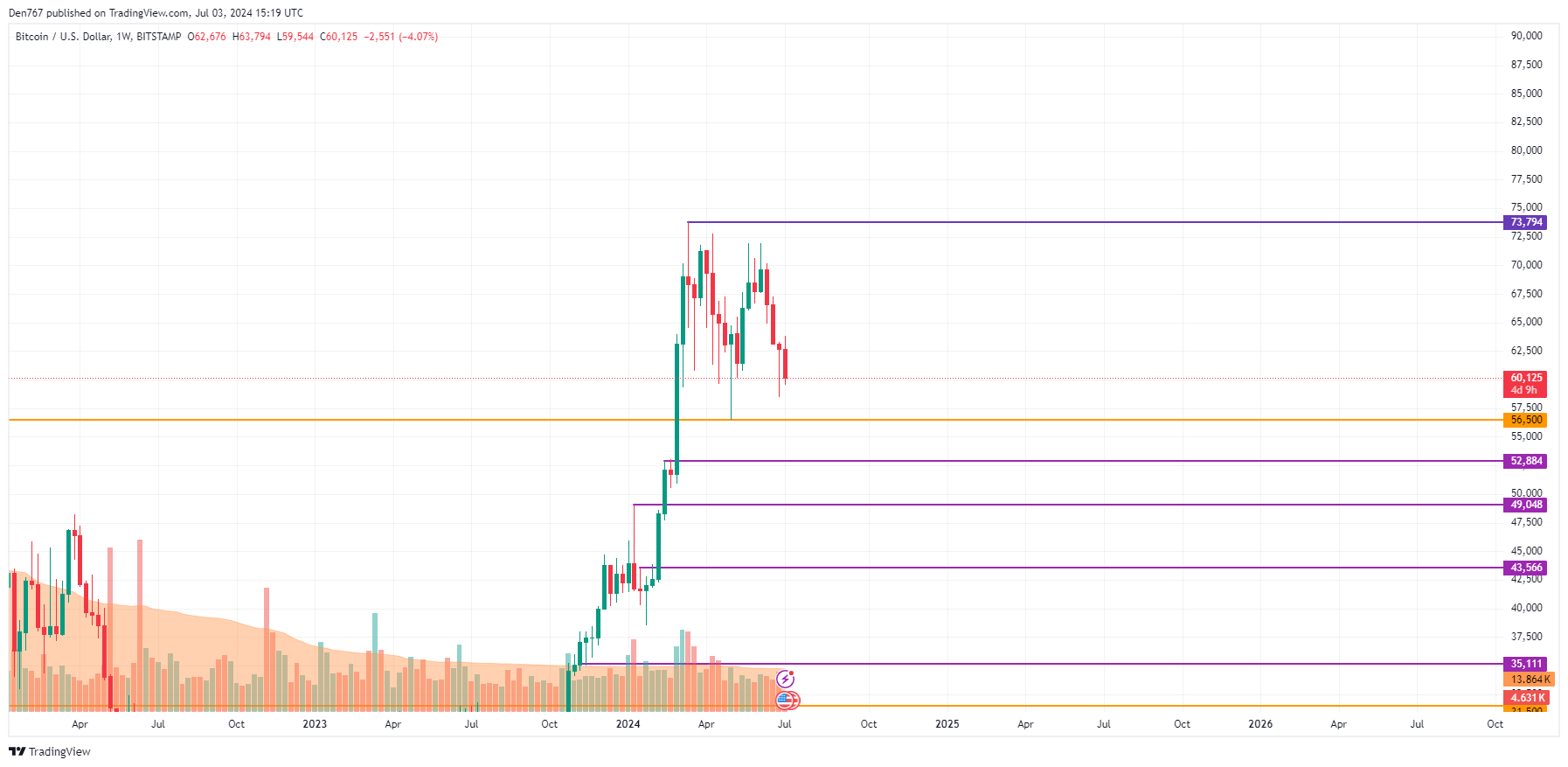

Bitcoin(BTC)has experienced a3.25%drop over the lastday,reflecting a broader markettrend.Despitetoday’sdecline,BTC’sprice remains on a bearishtrajectory,approaching the local support level of$59,544.If the daily bar closes below the critical zone of$60,000,a test of$58,000islikely.

KeySupportandResistanceLevels

Sellers appear more powerful than buyers on the daily timeframe.If this trendcontinues,and the bar closes near itslow,the fall is likely to extend to the support level of$56,500.From a midtermperspective,there are no reversal signalsyet.If buyers cannot seize the initiativesoon,traders may expect a supportbreakout,potentially moving to the$55,000range.

MarketSentimentandTechnicalAnalysis

The bearish sentiment in the Bitcoin market is driven by variousfactors,including low trading volumes and the impending expiration of substantial Bitcoinoptions.Technical indicators suggest thatBTC’sprice may continue to struggle unless a significant buying interestemerges.

Conclusion

Bitcoin(BTC)is at a criticaljuncture,with key support levelsapproaching.The current market sentiment and technical indicators suggest potential furtherdeclines.However,if buyers can regain control and push the price above key resistancelevels,a recovery could bepossible.Investors should closely monitor these levels and market trends to make informeddecisions.

- MarketAnalysis:UnderstandingthefactorsdrivingBitcoin’spricemovements.

- InvestmentStrategies:Navigatingvolatilityinthecryptocurrencymarket.

- TechnicalAnalysis:ToolsandtechniquesforpredictingBitcoin’sprice.