Andrew Left, a prominent short-seller and crypto-skeptic, faces 18 fraud charges and could spend up to 25 years in prison if convicted. The SEC alleges he manipulated the market through misleading public statements and trading activities.

Points

- Andrew Left faces 18 fraud charges and up to 25 years in prison if convicted.

- The SEC alleges Left engaged in illegal trading activities and market manipulation.

- Left made misleading public statements that contradicted his trading actions.

- The charges involve high-profile companies like Nvidia, American Airlines, and Meta.

- The Department of Justice has also filed a criminal case against Left.

Andrew Left, a well-known short-seller and vocal critic of the cryptocurrency industry, is facing serious legal trouble. The United States Securities and Exchange Commission (SEC) has charged Left with 18 counts of fraud, accusing him of engaging in illegal trading activities and market manipulation. If convicted on all charges, Left could spend up to 25 years in prison.

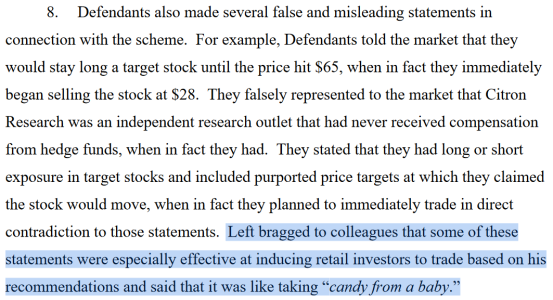

According to the SEC, Left used his position as a prominent financial commentator to manipulate the market for his own gain. He allegedly made public statements about various stocks that contradicted his actual trading activities, misleading investors and causing significant market fluctuations. The SEC’s complaint highlights that Left would often recommend selling stocks to his followers while secretly buying them, or vice versa, creating a false impression of market sentiment.

The charges involve some high-profile companies, including Nvidia, American Airlines, Alibaba, Meta (formerly Facebook), and X (formerly Twitter). The SEC alleges that between March 2018 and December 2023, Left made 26 trades from 23 companies using deceptive practices. His actions are said to have created a false perception of market conditions, allowing him to profit from the resulting price movements.

In addition to the SEC’s civil charges, the Department of Justice (DOJ) has also filed a criminal case against Left. The DOJ accuses him of committing securities fraud and lying to federal law enforcement about his compensation from hedge funds. These charges further complicate Left’s legal situation and underscore the severity of the allegations against him.

Left has been a vocal skeptic of the cryptocurrency industry, often labeling it as rife with fraud. In a 2022 interview, he stated, “I think crypto is just complete fraud, over and over and over.” His strong anti-crypto stance has made him a controversial figure within the financial community.

Excerpt from the SEC’s Complaint

“Left bought back stock immediately after telling his readers to sell, and he sold stock immediately after telling his readers to buy. This fraudulent practice deceived investors and allowed Left to use his Citron Research reports and tweets as catalysts from which he could derive short-term profits,” the SEC complaint reads.

Implications for the Financial Community

The case against Andrew Left highlights the potential for abuse of influence by financial commentators and the importance of transparency in market activities. If Left is found guilty, it could lead to stricter regulations and oversight of market commentary and trading practices to prevent similar instances of market manipulation.

The charges against Left also serve as a reminder of the risks associated with following investment advice from public figures without conducting independent research. Investors are encouraged to verify information and consider multiple sources before making trading decisions.

Conclusion

Andrew Left’s legal troubles underscore the critical need for ethical practices in financial commentary and trading. The SEC and DOJ’s actions against him highlight the importance of transparency and integrity in the market. As the case unfolds, it will be closely watched by the financial community for its potential impact on regulations and market practices.

解説

- Andrew Left faces serious legal charges for alleged market manipulation and fraudulent trading practices.

- The SEC and DOJ’s actions highlight the importance of transparency and ethical behavior in financial markets.

- The case could lead to stricter regulations and oversight of market commentary and trading activities.

- Investors should exercise caution and verify information from multiple sources before making investment decisions.

- The outcome of this case will have significant implications for market practices and regulatory frameworks.