Despite a market downturn, some cryptocurrencies have shown resilience and potential for recovery. Bitcoin, Litecoin, and TRON are among the top picks for investors to watch this week due to their notable performances and recovery potential.

Points

- Bitcoin dropped to a 5-month low but shows potential for recovery.

- Litecoin slumped 12% but has key resistance levels to watch.

- TRON bucked the trend, hitting a 4-month high.

- The global crypto market cap dropped to $2.11 trillion.

The cryptocurrency market experienced significant losses last week, with the global market cap falling to $2.11 trillion, its lowest level since February. However, a few assets showed notable resilience and potential for recovery.

Bitcoin Drops to 5-Month Low

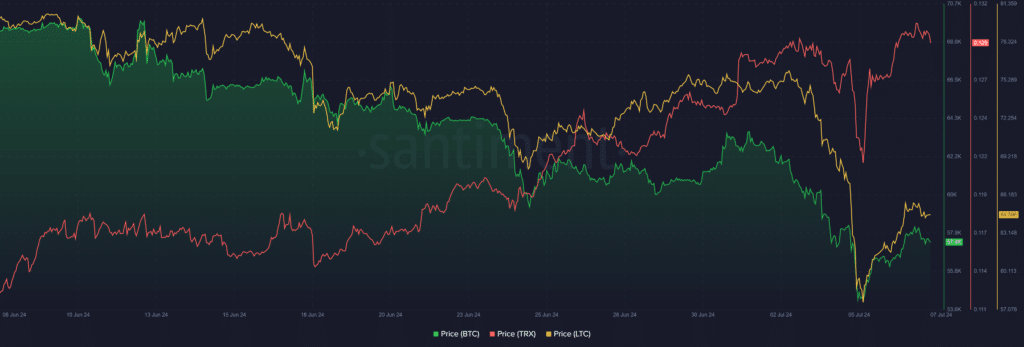

Bitcoin lost several key support levels, dropping from $63,000 to $53,485 on July 5. Despite a mild recovery, BTC ended the week down 4.5%, trading slightly above $58,000. The asset’s ability to reclaim the 20-day SMA and upper Bollinger Band will be crucial for a full recovery.

Litecoin Slumps 12%

Litecoin faced consecutive losses, dropping 18.6% over three days. A mild rebound on July 6 saw LTC gain 5.72%, but it still ended the week with a 12.7% loss. Closing above the Fibonacci 0.236 level at $64.60 is essential for preventing further declines.

TRON Bucks the Trend

TRON saw a 3.5% increase over four days, reaching $0.12997 on July 3. Despite a mid-week drop, TRX rebounded, closing last week with a 3.5% gain and hitting a four-month high of $0.13028.

BTC, TRX and LTC prices – July 7 | Source: Santiment

解説

- Bitcoin’s performance will be crucial for market sentiment, with key resistance levels at $61,509 and $66,676.

- Litecoin needs to close above $64.60 to mount a strong defense against further declines.

- TRON’s bullish momentum and

解説 (continued)

- TRON’s bullish momentum indicates strong investor interest and potential for further gains.

- The global market downturn highlights the importance of monitoring key support and resistance levels for potential investment opportunities.