Notcoin (NOT) has surged by 51.6% in the past 24 hours, with a significant increase in daily trading volume. Investors are betting on a pullback, highlighting the market’s volatile nature and potential for short-term gains.

Points

- Notcoin surged by 51.6% in 24 hours, trading at $0.0158.

- Daily trading volume skyrocketed by 307%.

- The asset’s market cap stands at $1.6 billion.

- The increase in open interest and short positions indicates investor speculation.

Notcoin (NOT) has experienced a remarkable rally, surging by 51.6% in the past 24 hours and trading at $0.0158 at the time of writing. The asset’s market cap currently sits at $1.6 billion, making it the 50th-largest cryptocurrency by market capitalization.

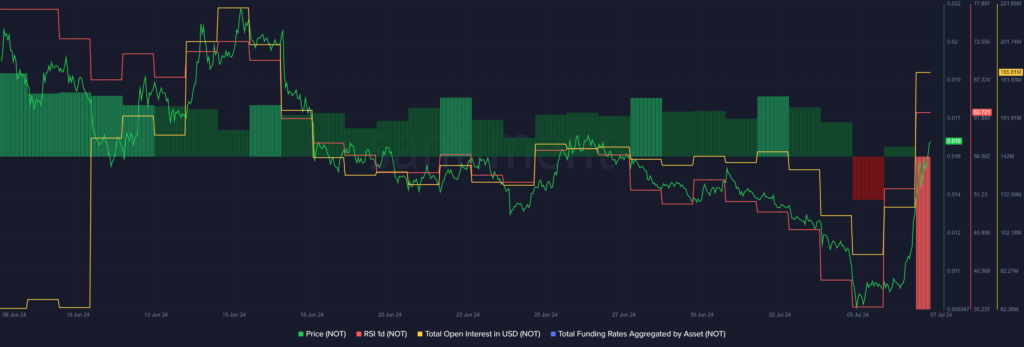

According to data from market intelligence platforms, the total funding rate aggregated by NOT plunged from 0.001% to negative 0.02% in the past 24 hours. This movement indicates that the asset’s open interest has majorly increased with short trading positions, suggesting that many traders are betting on Notcoin’s price falling in the near term.

Per Santiment data, the Notcoin Relative Strength Index (RSI) surged from 52 to 62 over the past day. The RSI is a technical indicator used to measure the speed and change of price movements. An RSI above 70 typically indicates an asset is overbought, while an RSI below 30 suggests it is oversold. With Notcoin’s RSI currently at 62, it is slightly overbought at this price point, raising the possibility of whales taking short-term profits.

Market Dynamics and Speculation

For Notcoin to remain in the bullish zone, its RSI needs to cool down below the 50 mark. The sharp increase in trading volume, which skyrocketed by 307%, indicates heightened market activity and interest in NOT. Such substantial acquisitions often precede price increases, suggesting optimism about Notcoin’s future prospects.

Investors banking on upcoming developments or strategic partnerships could drive the coin’s value higher. However, the significant open interest and short positions highlight the volatile nature of the market, with many traders speculating on a potential price pullback.

解説

- Notcoin’s recent rally exemplifies the high volatility and speculative nature of the cryptocurrency market.

- The surge in trading volume and market cap indicates strong investor interest and confidence in NOT.

- Technical indicators like the RSI provide insights into potential overbought or oversold conditions, helping traders make informed decisions.

- Understanding market dynamics, including open interest and funding rates, is crucial for anticipating price movements and potential pullbacks.

- Investors should remain cautious and monitor key indicators to navigate the speculative landscape of cryptocurrency trading effectively.