Solana’s price breaks past key resistance levels with futures open interest nearing all-time highs, driven by strong fundamentals and investor sentiment.

Points

- Bullish Breakout: Solana

Solana Price Flips Key Resistance as Futures Open Interest Nears ATH

-

– title start — Solana Price Flips Key Resistance as Futures Open Interest Nears ATH — title end —

-

– start content —

Solana’s price breaks past key resistance levels with futures open interest nearing all-time highs, driven by strong fundamentals and investor sentiment.

Points

- Bullish Breakout: Solana’s price breaks key resistance levels.

- Futures Open Interest: Nearing all-time highs, indicating strong demand.

- Fundamentals: Robust ecosystem fees and anticipated ETF filings.

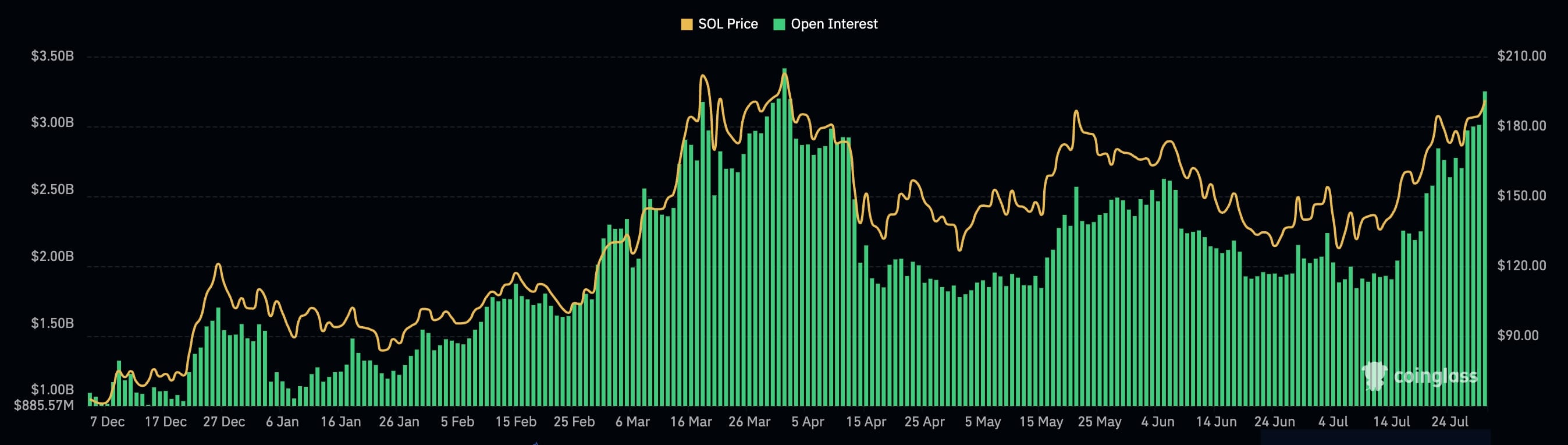

Solana’s price made a strong bullish breakout on Monday as investors embraced a risk-on sentiment ahead of key macroeconomic events. The futures open interest has been robust after bottoming at $1.77 billion earlier this month as cryptocurrency prices dived. A higher open interest is usually a good sign of robust demand for an asset, suggesting that it may continue rising.

Strong Fundamentals Behind Solana’s Rally

Solana has exciting fundamentals backing its recent price action. Data shows that its ecosystem fees have jumped to $2.13 million in the last 24 hours. Participants in Polymarket believe that the blockchain will make higher fees than Ethereum, at least for a single day, this month.

Solana Price Zoomed Past Key Resistance

Technically, there are signs that this breakout could be real. On the daily chart, the token found a strong bottom at $120.50, where it failed to drop below four times since April. Solana also jumped above the crucial resistance point at $188.20, its highest point in May this year. Therefore, the token may continue rising as buyers target the year-to-date high of $210.15.

Macro Factors to Watch

Looking ahead, several macro factors could impact Solana’s prices this week. Companies like Franklin Templeton and BlackRock are expected to submit their Solana ETF documents to the Securities and Exchange Commission. Meanwhile, the biggest companies in the US, such as Amazon, Microsoft, Meta Platforms, and AMD, will publish their financial results. Last week, mixed earnings from companies like Tesla and Alphabet led to a big drop in US equities and some cryptocurrencies.

Conclusion

Solana’s strong bullish breakout and increasing futures open interest signal robust demand and positive investor sentiment. With strong fundamentals and anticipated ETF filings, Solana is well-positioned for further gains. Investors should keep an eye on macroeconomic events and company earnings that could influence its price movements.

解説

- Bullish Breakout: Solana breaks key resistance, indicating strong demand.

- Futures Open Interest: Nears all-time highs, suggesting robust investor interest.

- Macro Factors: Upcoming ETF filings and financial results could impact prices.