This article provides a short-term price prediction for Solana (SOL) on July 12, analyzing current market trends and technical indicators.

Points

- Solana (SOL) has experienced a 4.73% price drop in the last day.

- The hourly chart indicates bearish control, with potential further declines.

- Key support and resistance levels are identified for short-term trading.

Current Market Performance

Solana (SOL) has seen a 4.73% drop in the last 24 hours, indicating bearish control in the market. The hourly chart shows that the price is closer to support, suggesting potential further declines if buyers do not intervene.

Short-Term Outlook

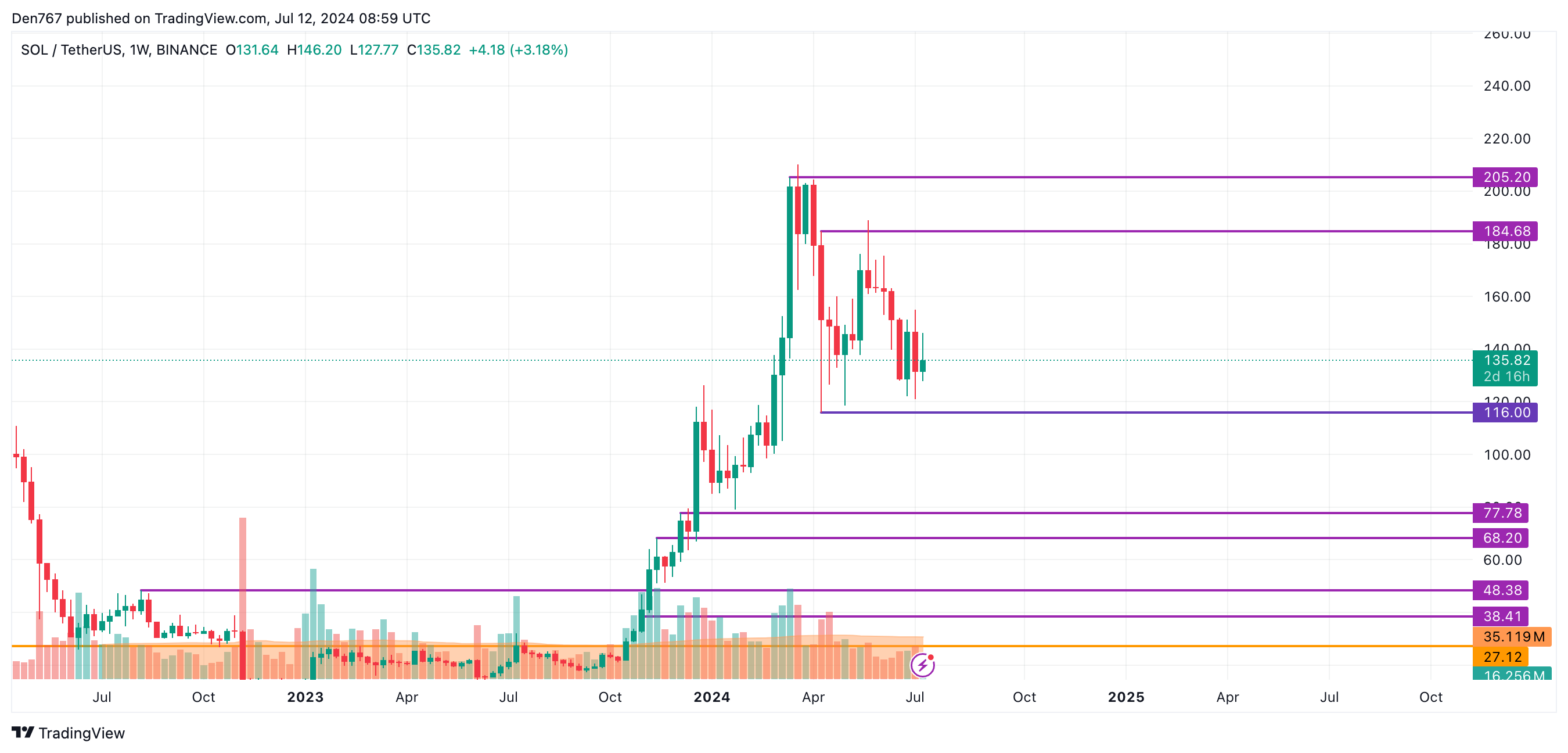

On the daily time frame, Solana is trading within a narrow range of $135 to $140. If the price closes around the current levels, consolidation is likely, with potential declines to $130 if bearish momentum persists.

Mid-Term Analysis

From a mid-term perspective, traders should focus on the weekly bar closure. If Solana closes near the $120 mark, it might trigger a breakout, potentially leading to a significant price movement towards $100.

Conclusion

Solana’s short-term price prediction indicates bearish momentum, with key support and resistance levels to watch. Traders should monitor market trends and technical indicators closely.

解説

- Technical Indicators: Analyzing key technical indicators such as moving averages and support/resistance levels helps traders make informed decisions. Solana’s current bearish trend suggests caution for short-term investors.

- Market Sentiment: Understanding market sentiment and its impact on price movements is crucial. Bearish sentiment can lead to further declines, while bullish intervention can stabilize prices.

- Trading Strategies: Traders should consider various strategies, including setting stop-loss orders and monitoring key support levels, to mitigate risks in a bearish market. Adapting to market conditions and staying informed are essential for successful trading.