Crypto analyst Rekt Capital provides an in-depth analysis of Chainlink (LINK) and SUI, examining key support and resistance levels and their potential future trajectories.

Points

- Market Analysis: Detailed examination of Chainlink and SUI’s price movements.

- Support and Resistance Levels: Key levels that could influence future price action.

- Price Predictions: Insights into potential future price movements for LINK and SUI.

- Market Trends: Overview of current market trends affecting these assets.

Renowned crypto analyst Rekt Capital has shared his latest newsletter, providing a thorough analysis of the market trends for Chainlink (LINK) and SUI. His insights highlight crucial support and resistance levels for both assets, offering a detailed look at their recent price movements and potential future trajectories.

Chainlink Shows Resilience Amid Pullback

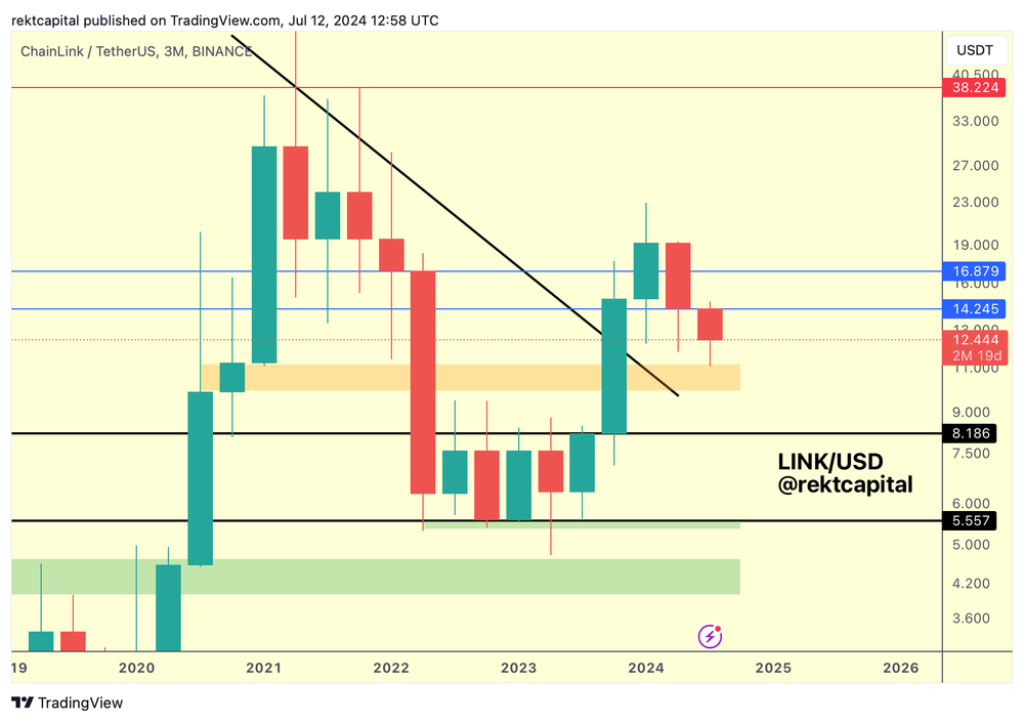

Despite a recent pullback, Chainlink (LINK) maintains its macro uptrend. The quarterly chart reveals an intriguing development, as LINK has been retracing for two quarters, finding support in a significant zone. This area previously acted as resistance in mid-2020 and Q3 2020, which may now serve as a crucial support level.

Rekt Capital suggests that further retesting of this support area may occur in the coming months, potentially indicating a consolidation phase before the next move. This behavior hints at a possible continuation of the macro uptrend for LINK.

SUI Navigates Key Price Levels

Turning attention to SUI, Rekt Capital identifies critical price levels that could influence its future trajectory. Currently, SUI is finding support at a light blue level, which may pave the way for upward momentum. However, the analyst cautions that SUI recently lost the $0.97 level as support, closing below it last month.

Rekt Capital explains that if SUI rebounds but rejects at the black level, it would confirm a new resistance. This scenario could significantly impact SUI’s short-term price action.

Conclusion

Rekt Capital’s analysis provides valuable insights into the price trajectories of Chainlink and SUI. While LINK shows resilience in its macro uptrend despite recent pullbacks, SUI navigates critical price levels that may influence its short-term movement. Investors should monitor these key support and resistance levels to make informed decisions.

解説

- Chainlink’s Uptrend: Despite recent pullbacks, LINK maintains a macro uptrend, finding support at significant levels.

- SUI’s Critical Levels: SUI faces crucial support and resistance levels that will determine its short-term price action.

- Market Analysis: Rekt Capital’s detailed examination of market trends for LINK and SUI.

- Investment Insights: Important takeaways for investors based on current market analysis and price predictions.