This article discusses the recent surge in Brett’s price, key chart patterns, and alternative investment opportunities in the meme coin sector. It includes predictions and technical analysis from top analysts.

Points

- Brett price surges by 10% with a potential for further gains.

- Analysts predict a Bull Flag breakout for altcoins.

- Bitcoin trading near $70,000.

- Alternative meme coins like Base Dawgz offer high returns.

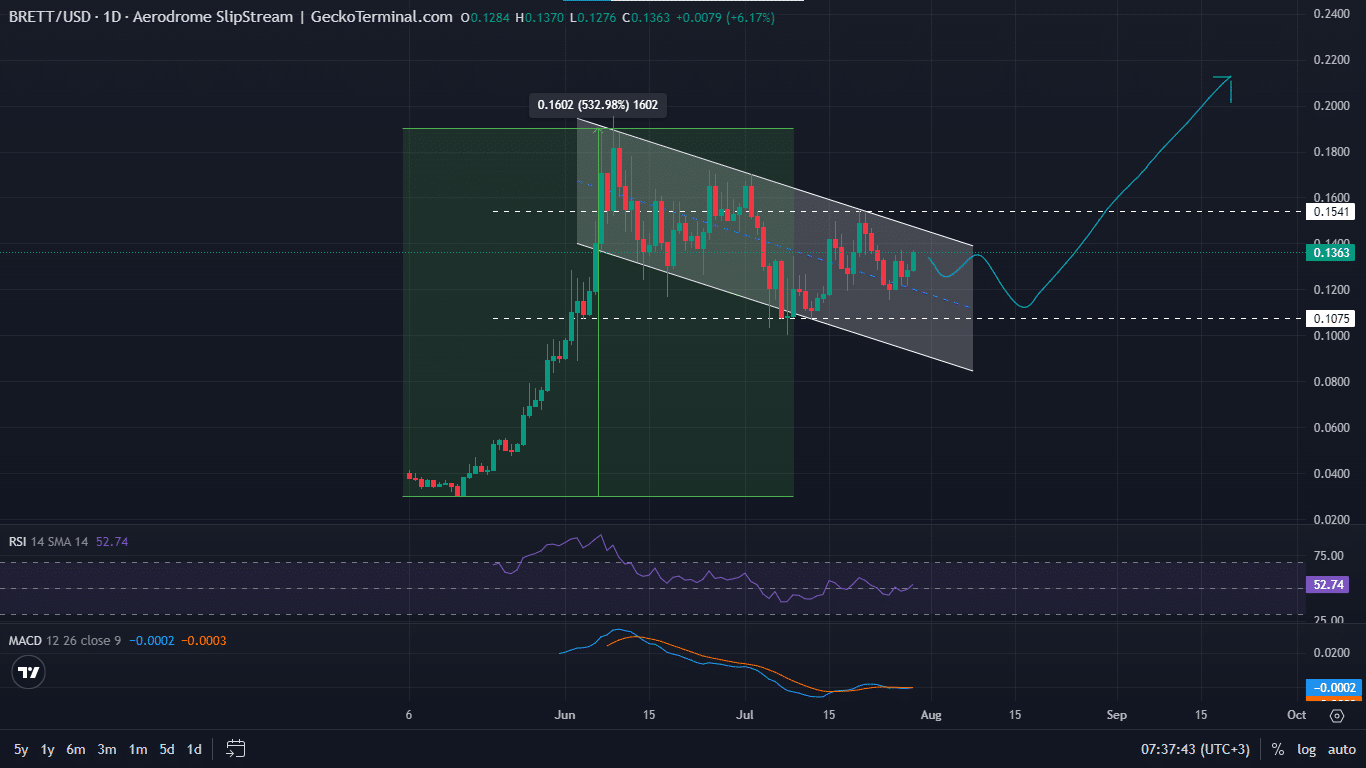

Brett has seen a 10% price surge, trading at $0.1363 as of early this morning. Analyst Javon Marks predicts a Bull Flag breakout for altcoins, which could spark a massive continuation to new all-time highs. Marks identifies two potential targets for TOTAL3: $1.04 trillion and $1.80 trillion, signaling a strong bull run for alternative cryptocurrencies.

Bitcoin is currently trading at $69,519.33, up 3.23% over the last 24 hours. Investors are keenly watching Bitcoin’s next bullish target of $70,000. As Bitcoin approaches this milestone, altcoins, including Brett, are likely to gain momentum. Increased buying pressure above current levels would see the Brett price clear the $0.1541 resistance level, setting the stage for further gains.

If traders begin to book profits, Brett’s price could retract. A break below $0.1075 would confirm a downtrend, invalidating the bullish outlook. Meanwhile, investors are considering alternatives like Base Dawgz (DAWGZ), which promises high returns and has already raised $2.7 million in funds.

解説

- Brett’s price movement is closely linked to Bitcoin’s performance and broader market trends.

- The Bull Flag pattern is a strong indicator of potential price rallies.

- Alternative investments like Base Dawgz offer high annual returns and diversification opportunities.

- Monitoring key resistance and support levels can help in making informed trading decisions.