An overview of the upcoming SEC meeting on Ripple, the speculation surrounding a potential settlement, and its impact on XRP’s price.

Points

- The SEC has scheduled a closed-door meeting potentially related to Ripple.

- The agenda includes the settlement of administrative proceedings and litigation claims.

- Speculation about a Ripple settlement is driving XRP’s price up.

- Whale transactions suggest strong investor confidence in XRP.

- Technical indicators send mixed signals, with a potential breakout if news is positive.

The cryptocurrency community is abuzz with speculation as the SEC prepares for a closed-door meeting on July 25th, which many believe could lead to a settlement in the ongoing Ripple case. The meeting’s agenda includes the institution and settlement of administrative proceedings, resolution of litigation claims, and other matters relating to examinations and enforcement proceedings.

XRP Price Movements

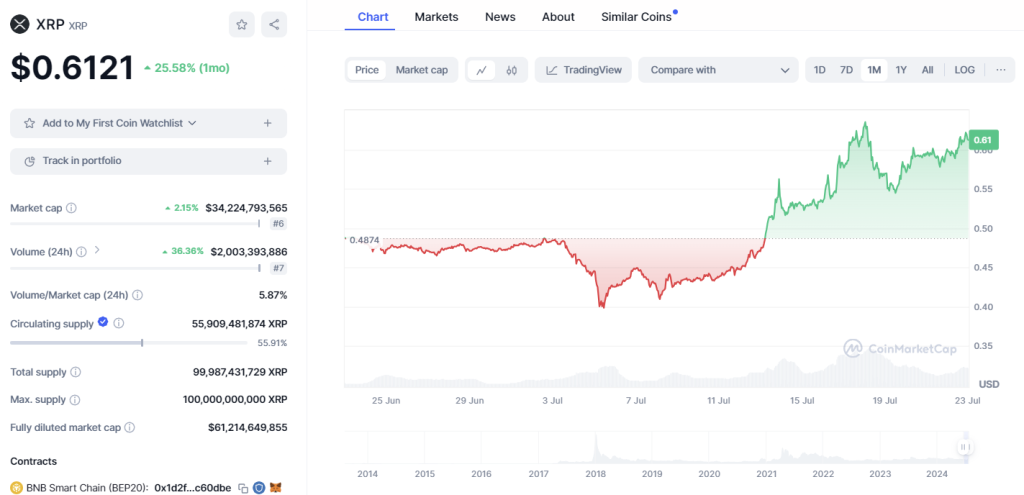

The anticipation of a potential settlement has caused a surge in XRP’s price, pumping over 10% and trading around $0.61. Whale transactions, with 48 million XRP purchased this week, indicate strong confidence among major investors.

Source: CoinMarketCap/XRP

Source: CoinMarketCap/XRP

Technical indicators, however, send mixed signals. The Relative Strength Index (RSI) is below 45, suggesting XRP is not in the bullish zone. Additionally, the Moving Average Convergence Divergence (MACD) line is below the MACD signal line, another bearish sign. Despite this, if news from the meeting is indeed positive, the price might break the $0.7 resistance, potentially opening the way to higher levels.

Whale Transactions and Investor Sentiment

The recent surge in whale transactions highlights strong investor confidence in XRP. Major investors purchasing significant amounts of XRP suggests they anticipate favorable outcomes from the SEC meeting. This increased activity supports the bullish sentiment surrounding Ripple’s potential settlement.

Technical Analysis and Market Outlook

Despite the mixed technical indicators, the market sentiment remains cautiously optimistic. A potential settlement could act as a major catalyst for XRP, propelling its price to new highs. If the RSI and MACD signals improve post-meeting, XRP could see a substantial breakout.

Next Big Airdrop?

Speculation about the SEC meeting extends beyond just a settlement. Investors are also eyeing potential airdrops and other incentives that Ripple might announce following a positive resolution. Such developments could further boost investor confidence and drive up XRP’s price.

Conclusion

The upcoming SEC meeting on July 25th holds significant implications for Ripple and XRP. The anticipation of a settlement has already driven up the price, and positive news could lead to a substantial breakout. Investors should keep a close watch on the meeting’s outcomes and be prepared for potential market movements.

解説

- The SEC’s closed-door meeting has heightened speculation about a possible Ripple settlement, driving up XRP’s price.

- Whale transactions indicate strong investor confidence, with major purchases suggesting anticipation of favorable outcomes.

- Technical indicators are mixed, but a positive resolution from the SEC could lead to a significant price breakout for XRP.

- Investors should monitor the meeting closely and be ready to react to market changes based on the outcomes.

- The potential for additional incentives, such as airdrops, adds to the positive sentiment surrounding Ripple and XRP.