The Australian Securities and Investments Commission (ASIC) has filed a lawsuit against the Australian Securities Exchange (ASX) for misleading the public about a blockchain-based software upgrade. The upgrade, which was intended to modernize the trading system, ended in failure, resulting in a $250 million write-off and raising serious concerns about market integrity and trust.

Points

- Lawsuit Filed: ASIC has sued ASX over the failure of a $250 million blockchain-based software upgrade.

- Misleading Statements: ASX misled the public by claiming the project was on track when it was not.

- Project Failure: The project faced significant delays and technical issues, leading to its eventual cancellation.

- Market Trust Impact: The lawsuit highlights concerns about transparency and trust in the financial markets.

In a significant development that has sent shockwaves through the Australian financial sector, the Australian Securities and Investments Commission (ASIC) has taken legal action against the Australian Securities Exchange (ASX) over a failed $250 million blockchain software upgrade. The lawsuit alleges that ASX misled the public and investors about the progress and viability of the upgrade, which was intended to modernize the Clearing House Electronic Subregister System (CHESS) using cutting-edge blockchain technology.

The ASX Blockchain Upgrade: A Promising Project Gone Awry

The CHESS upgrade project began in 2016 with the ambitious goal of replacing the existing system with a blockchain-based solution. The new system was expected to revolutionize how trades were settled, offering increased efficiency, transparency, and security. However, the project soon encountered a series of setbacks, including unclear timelines, technical challenges, and poor communication between ASX and its software provider.

Despite these issues, ASX continued to assure the public that the project was “on track” and would be ready by April 2023. It wasn’t until November 2022 that ASX finally admitted the project was unlikely to succeed and decided to abandon it altogether. This admission came after an independent review by Accenture revealed significant flaws in the project’s execution, leading to a $250 million write-off.

ASIC’s Lawsuit: Allegations of Misleading Conduct

ASIC’s lawsuit against ASX is centered on the allegation that the exchange misled the market by making false and misleading statements about the progress of the CHESS upgrade. The regulator argues that ASX’s leadership failed to provide accurate and timely information, undermining investor confidence and damaging the integrity of Australia’s financial markets.

ASIC Chair Joe Longo described the situation as a “collective failure” by ASX’s board and senior executives, emphasizing that the exchange’s actions had far-reaching consequences for market trust. According to ASIC, the false assurances provided by ASX may have influenced investment decisions and eroded confidence in the exchange’s ability to manage critical infrastructure projects.

Market Trust and the Future of ASX

The fallout from the failed blockchain upgrade and subsequent lawsuit has raised serious questions about the governance and oversight of ASX. As Australia’s primary securities exchange, ASX plays a pivotal role in the financial system, and any loss of trust in its operations can have significant implications for the broader market.

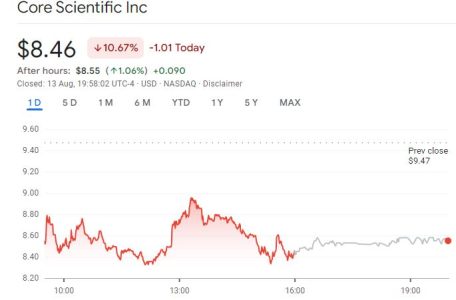

Investors have already begun to express concerns, with ASX’s stock price taking a hit following the announcement of the lawsuit. The exchange’s credibility is now under scrutiny, and it will need to work diligently to rebuild trust and demonstrate its commitment to transparency and accountability.

What Comes Next?

As the legal proceedings unfold, ASX could face substantial penalties if ASIC’s claims are upheld in court. The case also serves as a stark reminder of the risks associated with large-scale technology projects, particularly in the highly regulated financial sector. For ASX, the priority will be to address the issues raised by ASIC and take steps to prevent similar failures in the future.

The lawsuit is the first time ASIC has taken ASX to court over a failed project of this magnitude, marking a significant moment in the regulation of Australia’s financial markets. The outcome of this case will likely have lasting implications for how exchanges and other financial institutions approach technology upgrades and the level of transparency required in communicating with the public and investors.

解説

- Regulatory Implications: ASIC’s lawsuit against ASX could set a precedent for how regulators handle failures in technology projects, particularly those involving emerging technologies like blockchain. The case underscores the importance of accurate and transparent communication in maintaining market trust.

- Market Trust and Confidence: The failure of the CHESS upgrade and the subsequent lawsuit have damaged ASX’s reputation, highlighting the critical role that trust plays in financial markets. Restoring this trust will be a significant challenge for ASX moving forward.

- Lessons for Financial Institutions: The ASX case serves as a cautionary tale for financial institutions undertaking large-scale technology upgrades. It emphasizes the need for thorough planning, clear communication, and robust governance to avoid similar pitfalls.