The Bitcoin mining industry faces capitulation following the recent halvingevent,leading to financial stress and increased BTCoutflows.This article explores the implications of these challenges and the potential for marketrecovery.

Points

- Bitcoinminingindustryfacescapitulationpost-halving.

- Hashratefell7.7%,causingfinancialstressforminers.

- IncreasedBTCoutflowscontributetorecentpricedeclines.

- Historicalpatternssuggestpotentialmarketrecovery.

TheBitcoinminingindustryis experiencing capitulation following the recent halvingevent,indicating a potential local price bottom forBitcoin.Recent data from CryptoQuant suggests that the industry is facing financialstress,with the hash rate falling7.7%post-halving,hitting afour-monthlow.

Miners’FinancialStress

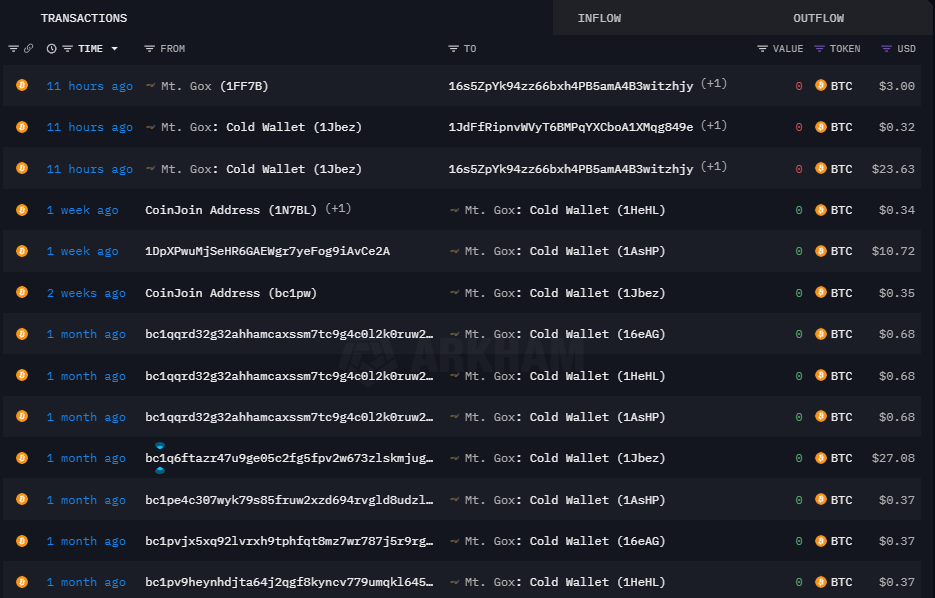

The significant drop in hash rate has led to increased financial stress forminers,causing many to sell their BTCreserves.Thissell-offhas contributed to the recent pricedeclines,as increased outflows put downward pressure onBitcoin’sprice.

Bitcoin HashRateDecline|Source:CryptoQuant

HistoricalPatternsandMarketRecovery

Historically,such a drawdown in hash rate has correlated with conditions whereBitcoin’sprice bottomsout.Forinstance,a similar7.7%hash rate decline occurred in December2022,whenBitcoin’sprice hit$16,000before increasing by over300%in the followingmonths.

These historical patterns suggest that the current hash rate decline could indicate that Bitcoin is nearing a localbottom,potentially setting the stage for a significantrecovery.Thesell-offbyminers,while contributing toshort-termpricedeclines,often precedes market rebounds as the selling pressuredecreases.

CurrentMarketConditions

The broader cryptocurrency market has also been affected by thesedevelopments,with many altcoins experiencing price drops in line withBitcoin’sdecline.However,on-chaindata shows that the concentration of large holders remainssteady,and transactions greater than$100Kcontinue to besignificant,suggesting sustained interest from institutionalinvestors.

Conclusion

The Bitcoin miningindustry’scapitulationpost-halvinghas led to increased financial stress and BTCoutflows,contributing to recent pricedeclines.However,historical patterns indicate that such conditions often precede marketrecoveries,suggesting that Bitcoin may be nearing a localbottom.Understanding these dynamics is essential for investors navigating the current volatilemarket.

解説

- MiningIndustryStress:TherecenthashratedeclineandfinancialstressamongminersarekeyfactorsinfluencingBitcoin’scurrentpricemovements.

- HistoricalRecoveryPatterns:Pastinstancesofhashratedeclineshaveoftenbeenfollowedbysignificantmarketrecoveries,indicatingpotentialforfuturepriceincreases.

- MarketConditions:Despitethecurrentdownturn,sustainedinterestfrominstitutionalinvestorsandsteadylarge-holderconcentrationssuggestunderlyingmarketstrength.

- InvestmentImplications:Recognizingthesignsofcapitulationandhistoricalrecoverypatternscanhelpinvestorsmakeinformeddecisionsinthevolatilecryptocurrencymarket.