This article analyzes the recent market anxiety following weak jobs data and portfolio reshuffling by Warren Buffett, exploring whether it’s a bubble bursting or an opportunity to invest in AI stocks like Nvidia, Intel, and TSMC.

Points

- Market anxiety triggered by weak jobs data and Warren Buffett’s portfolio changes.

- Analysis of the performance and future prospects of Nvidia, Intel, and TSMC.

- Examination of the potential impact of AI advancements on these stocks.

- Strategic considerations for investors in the current market climate.

Bubble Starting to Bust, or is it Time to Double Down on These AI Stocks?

This time around, the market anxiety follows Friday’s weak jobs report and Berkshire Hathaway’s 37.8% reduction of Apple (AAPL) stake in the Q2 earnings report. Serving as a market signal, Warren Buffett’s portfolio reshuffling has even gone viral.

Likewise, the Japanese Nikkei 225 index experienced the biggest drain in history, having closed more than 12% down. In fact, the loss of Nikkei’s 4,451 points was greater than during the “Black Monday” of October 1987, having lost 3,836 points then.

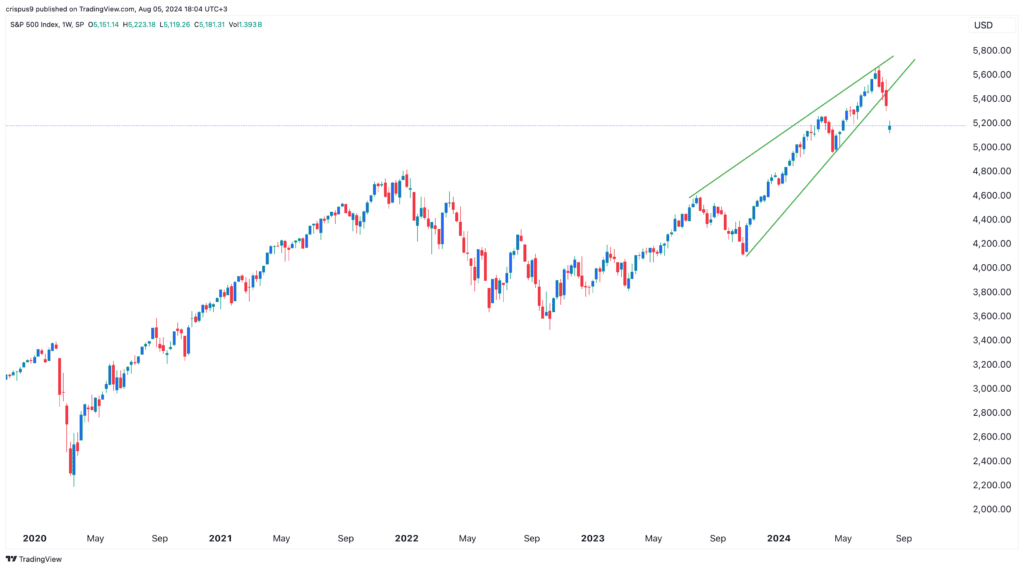

With the S&P 500 (SPX) down 5.10% over the week, the market benchmark reverted to early May 2024 levels. On the upside, the markets are pricing in 118 bp worth of interest rate cuts by December’s FOMC meeting, according to BofA Global Research.

Nvidia (NASDAQ: NVDA)

Just as H100 chips carried Nvidia over the $1 trillion market cap milestone, as they trained most large language models (LLMs), B200 are supposed to push the envelope further. The second-generation chips are purportedly 30x faster in inference performance while having 4x the training performance of H100s.

Moreover, with a 2.4x greater memory bandwidth for large datasets, B200s are supposed to reduce the power consumption by 25x while handling equivalent AI workloads. Given the fact that Google (NASDAQ: GOOG), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Meta (NASDAQ: META), Tesla (NASDAQ: TSLA), and Apple (NASDAQ: AAPL) rely on Nvidia’s AI chipsets, the delay into 2025 (from expected October) translates to major revenue delay.

According to UBS Group analyst Timothy Arcuri, B200 and GB200 superchips should account for 7% of Nvidia’s total shipments ending January 2025, at 32,500 and 43,400 units

respectively. With the delay, this would account for around $3 billion missing out of the expected $34.5 billion.

In other words, as both fabless companies rely on TSMC, Nvidia’s competitor, AMD (NASDAQ: AMD), cannot exploit Nvidia’s delay. This still puts Nvidia as the main source of capital for post-market correction.

Intel (NASDAQ: INTC)

Moreover, Databricks’ January research found that Intel’s Gaudi 2 AI chip matches the performance of Nvidia’s H100 with even higher memory bandwidth utilization, making Gaudi 2 the top dollar-per-performance investment against H100/A100.

At Intel Vision 2024 conference in April, Intel revealed Gaudi 3 as having up to 50% memory bandwidth boost, purportedly on par with Nvidia’s H200. Although lower in performance than Nvidia’s delayed Blackwell series, it is expected that Gaudi 3 will also be a cheaper alternative, around half the cost of B200’s rumored $30k – $40k price range.

Image credit: IEEE Spectrum

At the time, Intel gave a $500 million revenue inflow outlook from Gaudi 3 shipments for 2024. For comparison, AMD’s MI300 series is expected to bring in $3.5 billion. However, with Nvidia’s design flow to be sorted out, this provides Intel space to accelerate its market position during 2025.

In the meantime, the predictable class action lawsuit, resulting from Intel’s 13th and 14th generation CPU instability issues, is having a suppressing effect on INTC price stock. But given Intel’s market dominance in the integrated GPU and CPU market, the current low point should be seen as an opportunity.

Taiwan Semiconductor Manufacturing Company (NASDAQ: TSM)

TSMC has been in an awkward position. On one hand, the company is the world’s top semiconductor foundry with cutting-edge chip node processes. On the other hand, its location in Taiwan, contested by China, makes it a risk-on investment exposure.

After Friday’s anxiety-inducing jobs report in the US, Taiwan’s weighted index Taiex dropped 8.3%, with TSM down 8.8%. Yet, with TSMC’s foundry capacities in full swing, the company’s wide moat remains fortified. After all, this is the world’s chipmaking chokepoint.

TSMC still expects Q3 revenue at $23.2 billion to beat expectations, having increased its Q2 revenue 32% year-over-year to $20.82 billion. To make the case that TSM decline is terminal is to make the case that the Big Tech sector will lose its competitive drive for generative AI.

Taking these factors into account, TSM’s price drop to $147.90 from $182.49 a month ago seems a solid buy-the-dip opportunity.

解説

- Market Anxiety: Recent market anxiety, driven by weak jobs data and Warren Buffett’s portfolio changes, has impacted major indices and stocks, creating volatility and investment opportunities.

- Nvidia’s Delays: Nvidia’s delays in releasing its B200 superchips could impact its short-term revenue, but the company remains a key player in the AI chip market, supported by its strong product lineup.

- Intel’s Positioning: Intel’s Gaudi 2 and Gaudi 3 chips position it as a strong competitor to Nvidia, with potential revenue growth as it addresses market challenges and leverages AI advancements.

- TSMC’s Strength: Despite geopolitical risks, TSMC’s dominance in semiconductor manufacturing and its revenue growth make it a compelling investment, particularly given the recent price decline.