Points

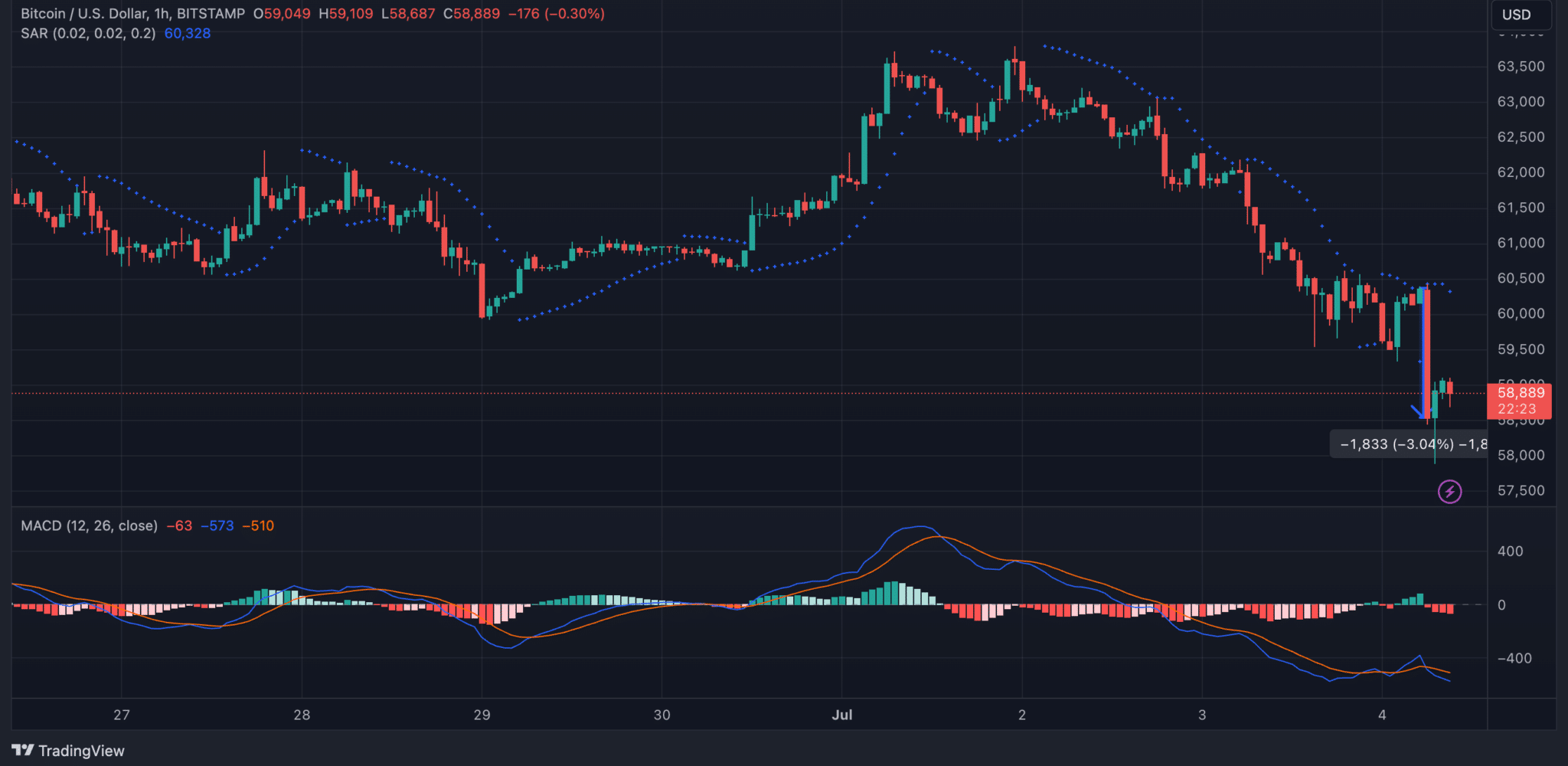

- Bitcoin’svaluehasfallenbelow$60,000,markinga4%declinewithinasingleday.

- ThebroadermarketretreathasaffectedothermajordigitalassetslikeEthereum,DOGE,BNB,andLINK.

- Mt.Gox’srepaymentprocess,startingthismonth,couldincreasemarketsupplywithover$9billioninBitcoin.

- Investorsentimentremainsneutral,withtheFear&GreedIndexat48.

The cryptocurrency market is experiencing adownturn,withBitcoin’svalue recently falling below$60,000,representing a4%decline within a singleday.This recent decrease has impactedBitcoin,marking it as one of the most affected cryptocurrencies during a broader market downturn that has also influenced other major digital assets such asEthereum,DOGE,BNB,andLINK.

BroaderMarketRetreat

This decline coincides with a broader market retreat of over4%in the last24hours,affecting these majorassets.

It is important to note that the Fear&GreedIndex,a measure of marketsentiment,indicated a neutral position at48,suggesting that investors are neither overly fearful nor excessivelygreedy,though uncertaintyprevails.

Mt.GoxRepaymentsAddPressure

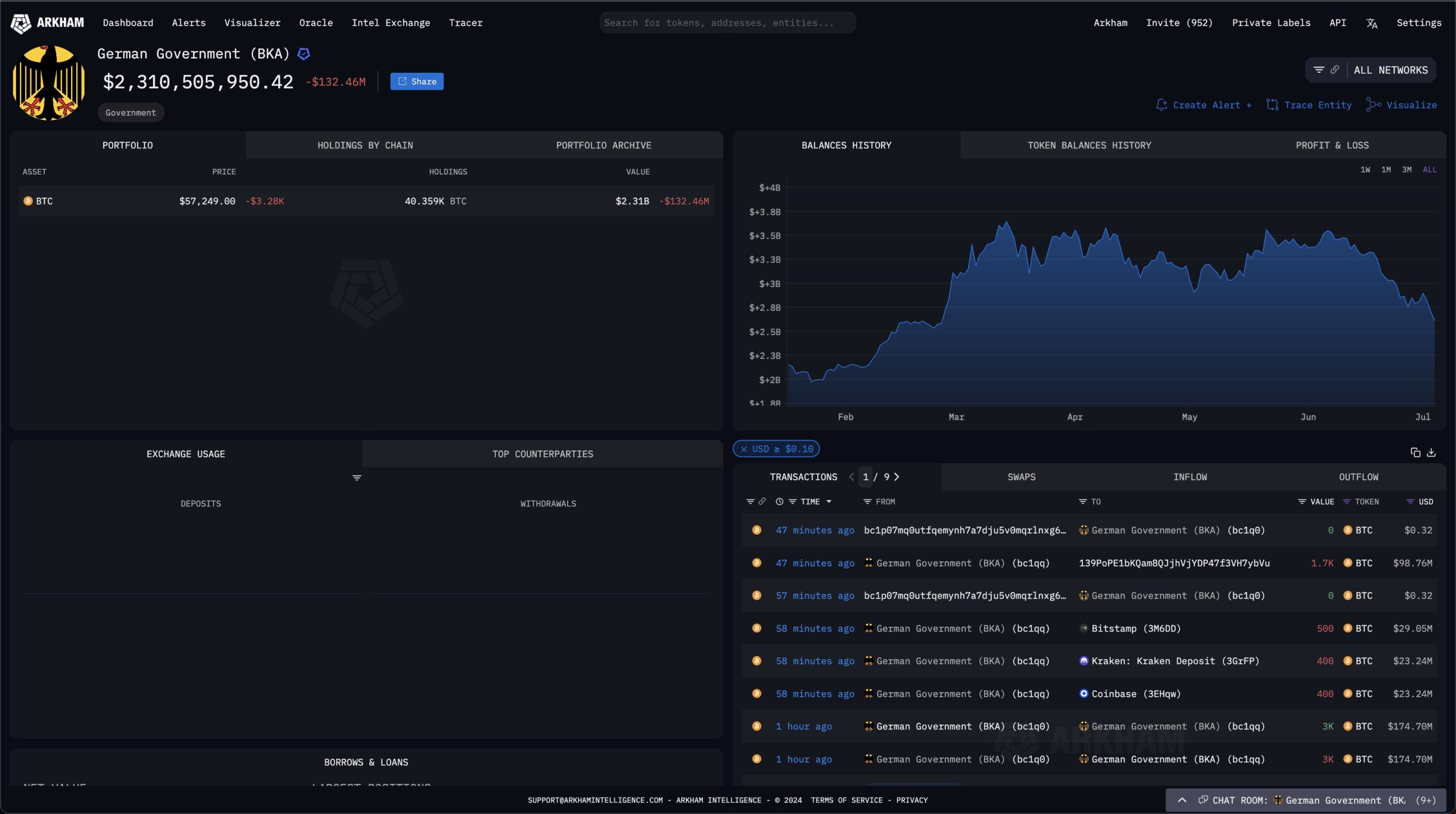

A contributing factor to this uncertainty is the anticipated repayment process byMt.Gox,set to begin thismonth.

Over$9billion in Bitcoin is due to be repaid to more than127,000creditors,many of whom may sell to realize theirprofits,adding selling pressure to themarket.

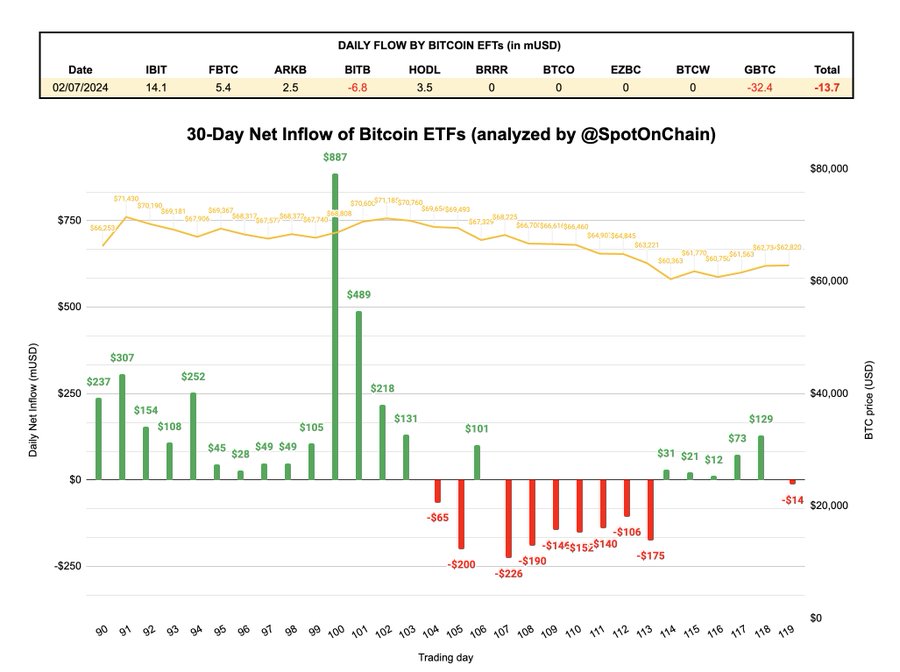

Furthermore,within Bitcoinexchange-tradedfunds(ETFs)in theU.S.have played a role in the ongoing marketsituation.After a period of inflows totaling$129.5million up until July1,a reversal occurred with an outflow of$13.7million on July2.

Theseoutflows,particularly a$32.4million withdrawal fromGrayscale’sBitcoinTrust,have countered earlier gains and raised investor concerns aboutBitcoin’spricestability.

🚨$BTC

🚨$BTC#ETFNetInflowJuly2,2024:-$14M!

•The net inflow turned slightly negative after being positive for5days.

•#Grayscale(GBTC)saw an outflow of$32.4M,larger than the sum of all other BitcoinETFs’inflows.

•#BlackRock(IBIT)had the largest inflow ofthe…pic.twitter.com/GvXMN34Gq6

https://twitter.com/spotonchain/status/1808354878663938277

PotentialPositiveShifts

https://x.com/ali_charts/status/1808341827579179328

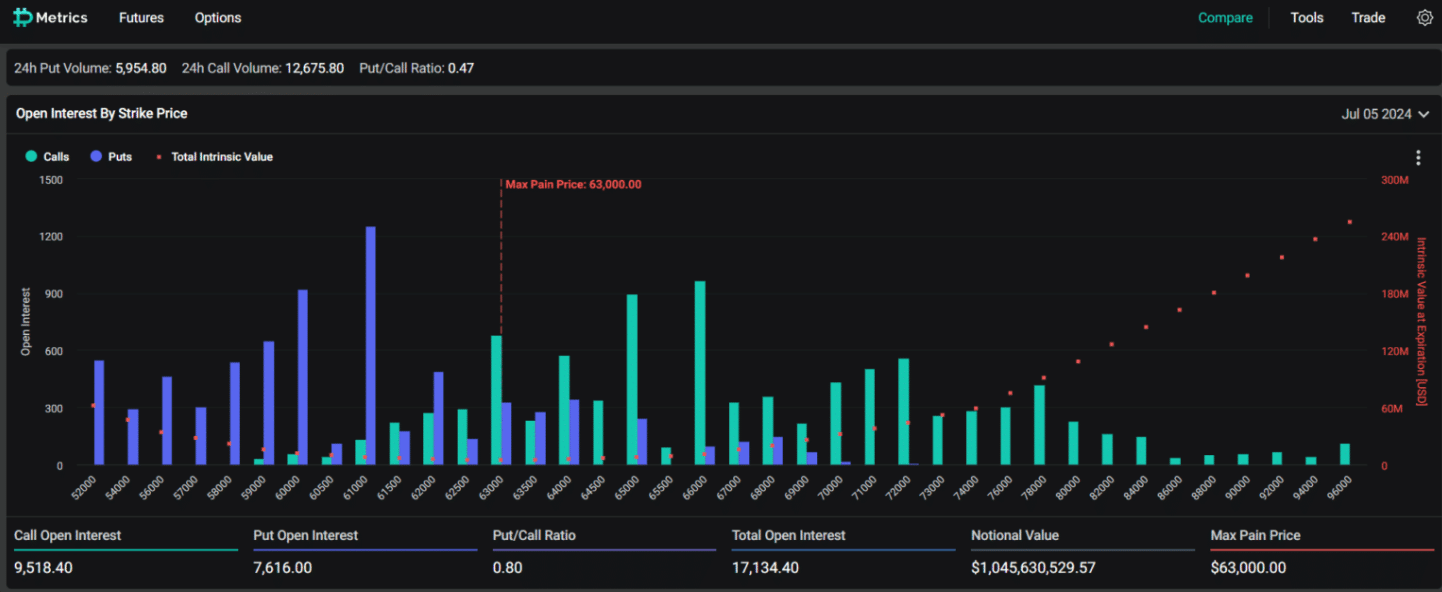

Over$1billion will be liquidated if#Bitcoinnow rebounds to$62,600!pic.twitter.com/6gBiTTkPiH

https://twitter.com/ali_charts/status/1808341827579179328

解説

- TherecentpricedropinBitcoinhighlightstheongoingvolatilityandsusceptibilitytoexternalpressures,suchaslarge-scalesell-offsandmarketsentiment.

- Mt.Gox’srepaymentprocessisasignificantfactorcontributingtomarketinstability,potentiallyincreasingthesupplyofBitcoinandaddingdownwardpressureonprices.

- TheFear&GreedIndexataneutralpositionsuggeststhatwhileinvestorsarecautious,thereisstillpotentialformarketrecoverywithpositivenewsorregulatorychanges.

- Analystsremaincautiouslyoptimistic,butwarnofpotentiallarge-scaleliquidationsifBitcoin’spricereboundssharply.