This article explores the recovery of Nvidia stock amid a broader crypto rebound led by Dogecoin, Jasmy, and Render. It examines the factors contributing to this recovery and the implications for investors.

Points

- Overview of Nvidia’s stock recovery.

- Analysis of Dogecoin, Jasmy, and Render’s performance.

- Factors driving the crypto rebound.

- Implications for investors and future outlook.

Nvidia Stock Recovers as Dogecoin, Jasmy, Render Lead Crypto’s Rebound

Nvidia stock crawled back on Monday, Aug. 5, giving all asset class investors hope that a buy-the-dip opportunity exists.

Is This All a Big Dead Cat Bounce?

Nvidia stock traded as low as $90.69 on Aug. 5 and investors sensed a buying opportunity as shares quickly reclaimed the $100 level. This rebound happened even as the Dow Jones dropped by over 1,000 points and the S&P 500 and the Nasdaq 100 index experienced its first-ever intraday 1,000-point decline.

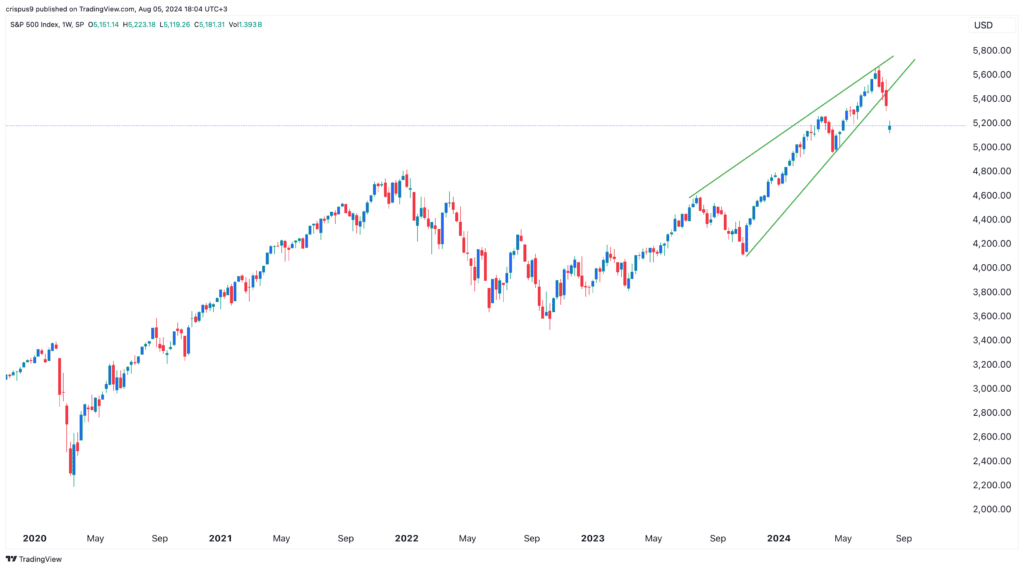

The other risk is that the S&P 500 index formed a high-risk rising wedge chart pattern on the weekly chart. In most cases, this pattern leads to more selloffs, as has already happened.

S&P 500 Index Chart. Source: TradingView

The Bullish Case for NVDA and Altcoins

Cryptocurrencies and other risky assets thrive when the Fed is slashing interest rates, as we saw during the Covid-19 pandemic. At the time, global stocks and cryptocurrencies soared even as the pandemic continued.

For Nvidia, the next important catalyst will come on August 28 when the company publishes its financial results. Analysts expect the numbers to show that revenue rose to $28 billion from $26 billion in Q1.

Dogecoin, Jasmy, and Render Performance

Technology stocks like Nvidia and cryptocurrencies have some correlation, which explains why altcoins like Render and Jasmy rose during the morning session in the US. These tokens rose as investors bought the dip after they became oversold. On the daily chart, Render’s Relative Strength Index (RSI) moved to 26 while Jasmy and Dogecoin’s fell to 24 and 27, respectively.

The implied market probability of a 50 basis point cut by the Federal Reserve in September suddenly surged from essentially de minimis to some 80% as traders increased their overall expectation of both the size and the speed of a Fed cutting cycle.

https://twitter.com/elerianm/status/1820179110292852773

Implications for Investors

The recovery of Nvidia stock and the rebound in cryptocurrencies like Dogecoin, Jasmy, and Render suggest that investors are regaining confidence in these assets. However, the market remains volatile, and investors should approach with caution.

Future Outlook

As the Federal Reserve potentially moves towards interest rate cuts, the market may see further recovery in technology stocks and cryptocurrencies. Investors should keep an eye on upcoming financial reports and macroeconomic developments.

解説

- Market Recovery: The recent recovery of Nvidia stock and certain cryptocurrencies highlights the market’s potential to rebound even amidst volatility. Investors should remain vigilant and informed about market trends.

- Correlation Analysis: The correlation between technology stocks and cryptocurrencies can provide strategic insights for investment decisions. Understanding these relationships can help investors identify opportunities and manage risks.

- Federal Reserve Actions: The Federal Reserve’s monetary policy decisions play a crucial role in market dynamics. Interest rate cuts could provide a favorable environment for asset recovery, but investors should monitor these developments closely.

- Investment Strategy: In a volatile market, a balanced investment strategy that includes diversified assets and a long-term perspective can help mitigate risks and capture potential gains.