Thelong-awaitedrepayment fromMt.Gox is finally arriving thismonth,bringing relief to over20,000creditors who lost their crypto investments in the2011cyberhack.This article explores the historical context and future implications of theserepayments.

Points

- Mt.Goxrepaymenttoover20,000creditorsbeginsthismonth.

- Theexchangelost950,000BTCina2011cyberhack.

- HistoricalBTCtransactionssuggestapotential9900%ROI.

- Futureimplicationsforcreditorsandthebroadercryptocurrencymarket.

Thelong-awaitedrepayment fromMt.Goxis finally arriving thismonth,bringing relief to over20,000creditors who lost their crypto investments in the2011cyber hack that saw the Japanese exchange lose950,000BTC.

HistoricalBTCChapter

At itspeak,Mt.Gox was the largest Bitcoin exchangeglobally,handling80%of all dollar Bitcointrades.However,according to theexchange,a critical bug led to the loss of950,000BTC.By February2014,Mt.Gox was declaredbankrupt.

What’sNext

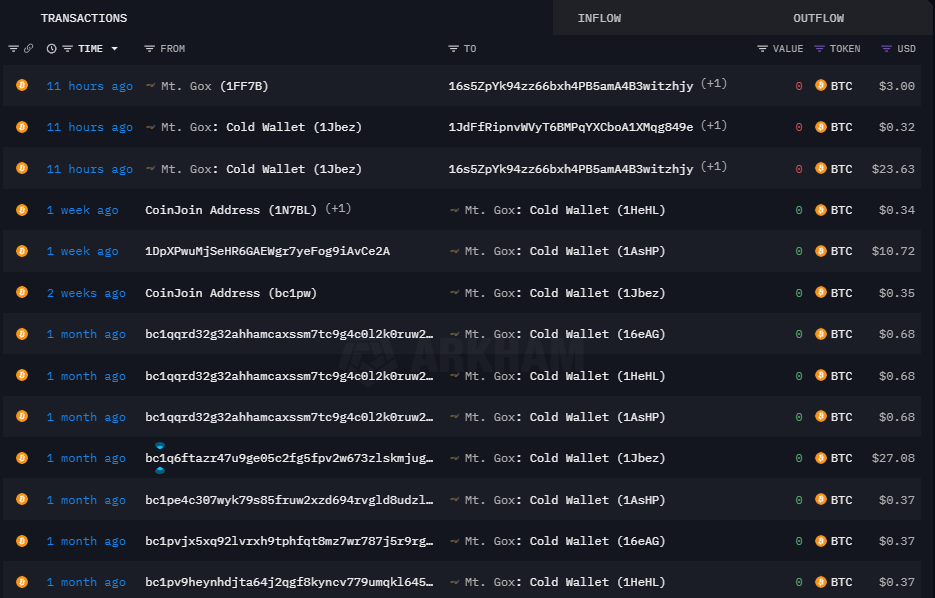

Arkham intelligence data shows thatMt.Gox has performed multiple small amount deposits and withdrawals to and from their wallets for the lastmonth.

Mt. GoxCryptoWalletChecks|Source:ArkhamIntelligence

ImplicationsforCreditorsandtheMarket

The repayment process will see creditors receiving a portion of their lostBitcoin,which,given the current value ofBTC,represents a

potential9900%return on investment(ROI).This repayment is a significant step for the victims of the hack and could have broader implications for the cryptocurrencymarket.

MarketImpact

The release of a substantial amount of Bitcoin back into the market could influence BTCprices,depending on how the creditors decide to manage their returnedassets.If a significant number of creditors choose to sell their Bitcoinimmediately,it could lead to increased selling pressure and potentially lowerprices.Conversely,if they hold onto theirBitcoin,it could signal strong market confidence and stabilize or even boost BTCprices.

FutureofMt.GoxandCreditorConfidence

The repayment marks an important milestone forMt.Gox and could help restore some confidence in the cryptocurrency exchangeecosystem.It also highlights the importance of robust security measures and regulatory oversight in preventing suchlarge-scalebreaches in thefuture.

Conclusion

TheMt.Gox repayment is a landmark event in the cryptocurrencyworld,offering substantial returns to creditors and potentially impacting the broadermarket.As the repayment processunfolds,the actions of the creditors and themarket’sresponse will be closelywatched,setting the stage for future developments in cryptocurrency exchanges and investorconfidence.

解説

- HistoricalContext:Mt.GoxwasoncethelargestBitcoinexchange,anditscollapsein2011duetoacyberhackmarkedasignificanteventinthehistoryofcryptocurrency.

- RepaymentProcess:Thelong-awaitedrepaymenttoover20,000creditorsisfinallybeginning,potentiallyprovidinga9900%ROIgiventhecurrentBTCvalue.

- MarketImplications:ThereleaseofasubstantialamountofBitcoinintothemarketcouldinfluenceBTCprices,dependingonwhethercreditorssellorholdtheirreturnedassets.

- FutureOutlook:Thisrepaymenthighlightstheneedforrobustsecuritymeasuresincryptocurrencyexchangesandcouldhelprestoresomeconfidenceintheecosystem.