This article examines the recent billion-dollar crypto crash, combined with the historic collapse of the Japanese stock market. It explores the causes, market reactions, and potential future implications for the global financial markets and the cryptocurrency sector.

Points

- Overview of the crypto market crash and Japanese stock market collapse.

- Analysis of the causes behind the crashes.

- Market reactions and investor sentiment.

- Potential future implications for global financial markets and the crypto sector.

Billion-Dollar Crypto Crash Combined with Japanese Market Collapse – What’s Next?

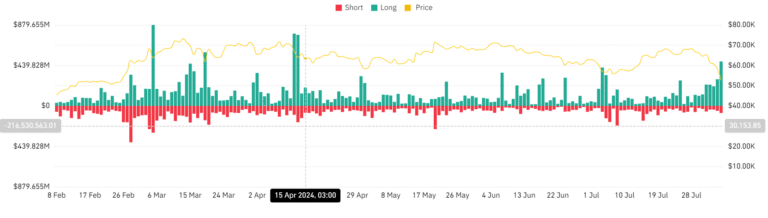

The crypto market has experienced a significant downturn, resulting in a liquidation of $1 billion in just 24 hours. This recent crash has caused concern and prompted analysts to look at the underlying causes.

Impact of the Japanese Stock Market on Cryptocurrencies

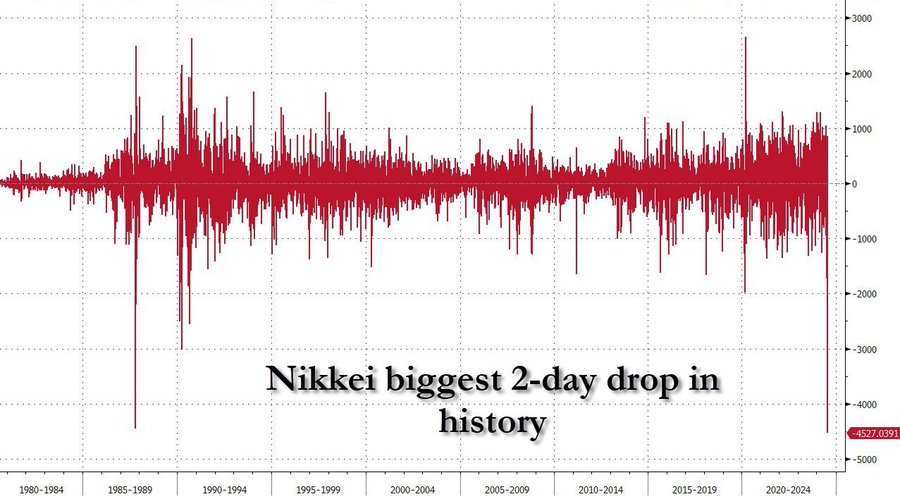

The Japanese stock market experienced the worst two-day plunge in recent history, surpassing even the infamous Black Monday crash of 1987.

“Japanese stocks (Nikkei 225) plunging over 25% from their highs to 30,900 support. If this support can hold, then could be a nice bounce coming. Jap stocks are crashing for two reasons.”

https://twitter.com/adamkhootrader/status/1820343807097160052

This downturn also affected the crypto market due to the interconnectedness of global financial systems.

Source: X

Causes Behind the Crashes

The Bank of Japan’s decision to raise interest rates to curb inflation and the stronger yen making Japanese exports less competitive have added to market fears and contributed to the sell-off in other markets, including Taiwan and South Korea.

Geopolitical Tensions Fuel Market Fears

Geopolitical unrest, particularly in the Middle East, has also played a key role in the recent volatility of crypto markets. The assassination of a Hamas leader by Israel and subsequent military activity in Lebanon have fueled fears of a wider regional conflict.

Market Uncertainty Following US Federal Council Decisions

Rumors that the Fed may cut interest rates to mitigate the impact of the Japanese market downturn have added to the uncertainty and triggered further liquidation in the crypto sector.

Source: Coinglass

Market Reactions and Investor Sentiment

The interconnectedness of global financial systems means that significant movements in one market can have ripple effects across others. The recent crashes have led to increased volatility and uncertainty, with many investors adopting a risk-averse stance.

Future Implications for Global Financial Markets and the Crypto Sector

As the market digests these significant events, investors will be closely monitoring central bank decisions, geopolitical developments, and market indicators. The broader implications for the global financial markets and the crypto sector include heightened awareness of market interconnectedness and the need for robust risk management strategies.

解説

- Global Market Interconnectedness: The recent crashes highlight the interconnected nature of global financial markets. Movements in one market can have significant ripple effects across others, emphasizing the need for comprehensive risk management strategies.

- Geopolitical and Economic Factors: The combination of geopolitical tensions and economic decisions, such as interest rate changes, can create a volatile market environment. Investors must stay informed about these factors and their potential impacts.

- Investor Sentiment and Behavior: Increased volatility and uncertainty often lead to risk-averse behavior among investors. Understanding market sentiment and behavior can provide insights into future market movements and opportunities.

- Strategic Responses: Investors should adopt strategic responses to navigate market volatility, including diversification, monitoring market indicators, and staying informed about central bank decisions and geopolitical developments. This proactive approach can help mitigate risks and capitalize on opportunities.