The article covers the approval of ETH ETFs for listing on U.S. exchanges, the expected impact on Ethereum prices, and investor excitement.

Points

- ETH ETFs approved for listing on U.S. exchanges.

- Investor excitement builds ahead of trading.

- Potential impact on Ethereum’s price and broader altcoin market.

- Key insights for investors regarding ETF entries and market positioning.

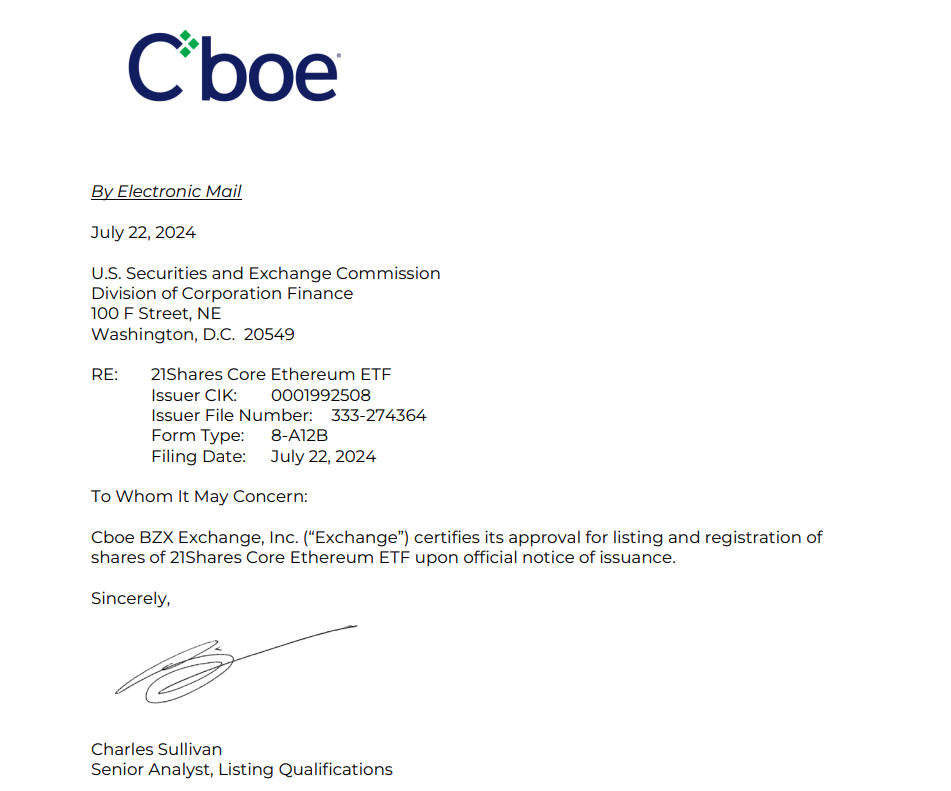

Exchanges in the U.S. have begun approving listings for Ethereum ETFs, marking a significant milestone for the cryptocurrency market. With trading set to commence soon, investor excitement is palpable as exchanges upload listing approvals to the EDGAR system.

The approved ETFs set to start trading include:

– Franklin Ethereum Trust

– VanEck Ethereum ETF

– Fidelity Ethereum Fund

– 21Shares Core Ethereum ETF

The final approval announcement from the SEC is anticipated after market close. This development has led to speculation about Ethereum’s price movement, with potential for significant gains if substantial inflows are observed. The launch of these ETFs could trigger a broader rally for altcoins, provided there are no major outflows.

解説

- The approval and upcoming listing of ETH ETFs on U.S. exchanges represent a major step forward for Ethereum, potentially driving increased institutional investment.

- Investor excitement and market speculation are high, with expectations of significant price movements based on ETF inflows.

- The broader altcoin market stands to benefit from positive sentiment and increased legitimacy stemming from the ETF listings.

- Investors should monitor early inflow numbers and market reactions to position themselves strategically in the evolving market landscape.

- The launch of these ETFs could set a precedent for further crypto-based financial products, enhancing market stability and investor confidence.